From pandemic to endemic, COVID-19 is presenting the industry a rare silver lining to reinvent travel insurance – which has indisputably been the most affected product. By default, the standard travel insurance does not cover known events; but this narrative is evolving with the constant changes in the travel restrictions.

As the virus is here to stay, more and more insurers are leveraging this crisis for new opportunities in COVID-19 coverage. Consumers want to travel and for the first time ever, travel insurance would be key to their plan. Plus, customer expectations today are at all-time highs for greater marketing convenience and product personalization.

Parallel to these opportunities are challenges as different countries impose different travel insurance coverage entry requirements. Traditional insurers are also plagued by ageing legacy systems which can impede innovation. That said, our approach seeks to bridge this gap – on one hand, enabling seamless distribution for insurers and travel platforms through embedded products (no doubt COVID-19 coverage is part of this); and on the other, customising the best-in-class travel insurance experience for every traveller’s unique needs.

Last December 2021, we sent out a survey questionnaire to 4,800 participants from 12 markets (Canada, United States, United Kingdom, Italy, Germany, France, United Arab Emirates, Singapore, Thailand, Indonesia, Japan and Australia) to understand how consumer sentiments towards travel insurance have changed in the endemic.

We also interviewed executives coming from Airlines, OTAs and travel solution providers to find out the key features of travel insurance during this period and what this means for insurance distributors and insurers in 2022.

The 2022 Travel Insurance Outlook is a 180+ pages report, encompassing the following sections:

Download the Global Travel Insurance Market Research 2022 for FREE

The topics covered in this whitepaper include, but are not limited to, the impact of travel destinations/origins on travel insurance take-up; consumer decision-making process and the purchase journey of travel insurance; and where embedded insurance stands creating a perfect customer experience.

The whitepaper is developed in tandem with insurers and distributors including air carriers. You’d be able to find that some of these consumer-data charts are accompanied by real-life case studies, and we glaze this off with further in-depth industry interview insights. Without further ado, let’s get started…

Food for Thought #1: We all want to travel again! What would affect consumer confidence to resume travel?

Despite COVID-19 concerns, consumers’ sentiments about travelling are positive in 2022. More than half of those surveyed indicated an interest to travel domestically, regionally and internationally (Least keen being Singapore with only 60% indicating interest, and most keen being 95% coming from the UAE region).

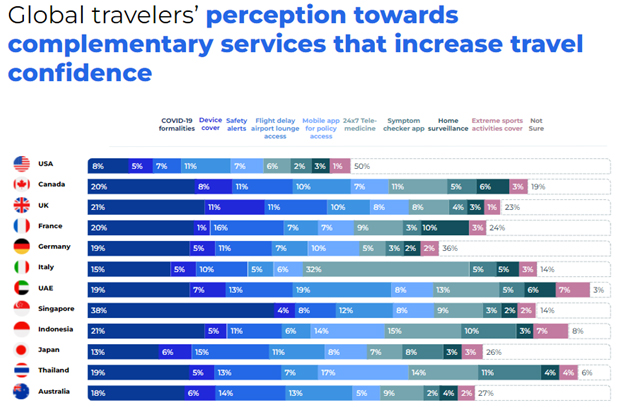

Amidst the ever changing travel restrictions, the general sentiment is that consumers are uncertain themselves as to what would affect travel confidence. However, as seen in the chart below, consumers in Asia-Pacific and UAE are more likely to be influenced by support for COVID-19 formalities to resume travel again.

This was further ascertained when we prompted them further on the top 3 benefits that would affect consumers’ take-up of travel insurance which were (1) Trip cancellation, (2) Emergency and medical expenses, and (3) General COVID-19 coverage. Safe to say that these are aspects pertaining to related crises happening overseas and last-minute changes in travel plans. That said, risk management is pertinent to what insurers do now as they are best-positioned to guide consumers through COVID-19 formalities.

Food for Thought #2: Do consumers prefer to purchase travel insurance directly from insurers or are they also open to buy from other travel players?

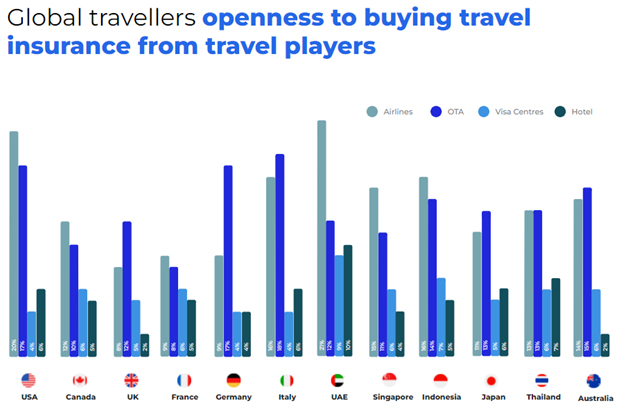

Purchasing travel insurance directly from insurers is preferred but consumers are also open to purchasing from travel players. As seen in the chart below, airlines and Online Travel Agencies (OTA) are unanimously related as the top travel players to purchase travel insurance apart from insurers.

Interestingly, in a separate question asked, the Americas, UK and France markets have the highest proportion of respondents (more than 20%) associating travel insurance with their credit cards and banks, and believing that they already have sufficient coverage of travel insurance from the aforementioned means.

Delving deeper into motivational factors for purchasing travel insurance from other travel players, price discounts come up as a clear contender, followed by convenience and personalization which are regarded more importantly for Indonesia, Thailand and UAE markets.

Food for Thought #3: How does embedded insurance help to perfect a customer experience, and where do partnerships stand in this regard?

If there’s one lesson we have taken away from the in-depth interviews conducted with air carriers and digital travel solution providers, it is that “one-size-fits-all is a thing of the past, as the consumers and circumstances will not allow for any compromises.”

“A key focus for 2022 will be to expand the availability of our travel insurance to cover more SIA markets. In addition, we will be looking into enhancing our product to offer consumers with a choice of two tiers of insurance plans, to provide greater flexibility to suit different budget needs.”

Singapore Airlines

Moving forward, personalised products along the lines of traveller profiles and market-specific travel requirements would become key for conversion and differentiation. Data analytics is at the heart of this personalization trend to enable you to effectively predict the relevance of the products for every given customer and provide tools that enable further customization that lead to more varied and competitive pricing schemes.

Every stage of the customer decision-making process can be enhanced via digital touchpoints to ease access to both information and services on a seamless, well-integrated platform which can improve the overall customer experience.

For example, one of the pain-points for policyholders in the post-purchase phase is making claims. It can be a painstaking process and one that creates anxiety when the policy-holders constantly have to check their home and email inboxes, and/or bank accounts to see if their claims have been deposited. Now… consider bringing the whole process of opening up the claim, uploading and submitting the receipts, and accessing the real-time status of the claim submission on an app, wouldn’t it make the lives of your customers so much easier?

“In 2022 we are focusing on improving the way we offer our ancillary products including insurance across our digital touchpoints. It’s important for us to make it as convenient as possible for our customers to tailor their journey, either as part of the flight booking or during the post booking phase.”

Salla Rinta-Kanto, Senior Business Manager, Product Offering, FinnAir

In the regard of partnerships, the aforementioned charts have illustrated the importance of travel insurance with COVID-19 coverage and in some Asian countries, travel insurance is mandated as an entry requirement. Beyond regulatory calls for greater collaboration, partnerships with digital travel solution providers in particular would also enable insurers to promote their offerings across more distribution channels expanding their target markets.

Download the Global Travel Insurance Market Research 2022 for FREE