Decisions## Overview of the Insurtech Market and Future Projections

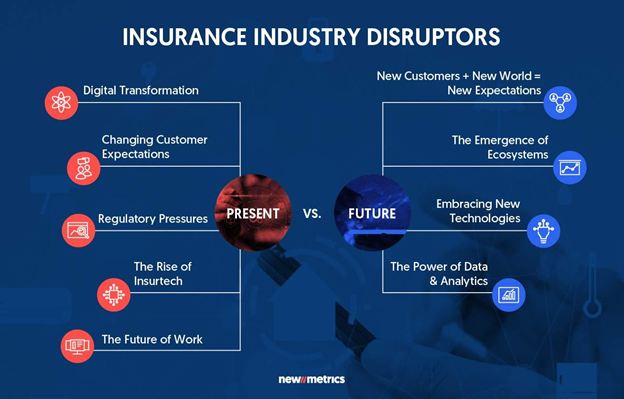

The insurtech industry has experienced a meteoric rise in recent years, disrupting the traditional insurance landscape with innovative technology solutions. This burgeoning sector, which combines insurance and technology, has attracted significant attention from investors, entrepreneurs, and consumers alike. As the world becomes increasingly digital, the demand for streamlined, efficient, and customer-centric insurance services has skyrocketed.

According to industry reports, the global insurtech market is projected to reach a staggering $152.7 billion by 2030, growing at a compound annual growth rate (CAGR) of 48.8% from 2022 to 2030. This remarkable growth trajectory is fueled by several factors, including the increasing adoption of digital technologies, the need for personalized insurance products, and the growing demand for seamless customer experiences.

Insurtech startups have seized this opportunity, leveraging cutting-edge technologies to revolutionize various aspects of the insurance industry, from underwriting and claims processing to customer engagement and risk management. However, amidst this technological disruption, profitability remains a critical challenge for many insurtech startups, necessitating strategic technology decisions to drive sustainable growth and long-term success.

Economic Challenges Facing Insurance Startups

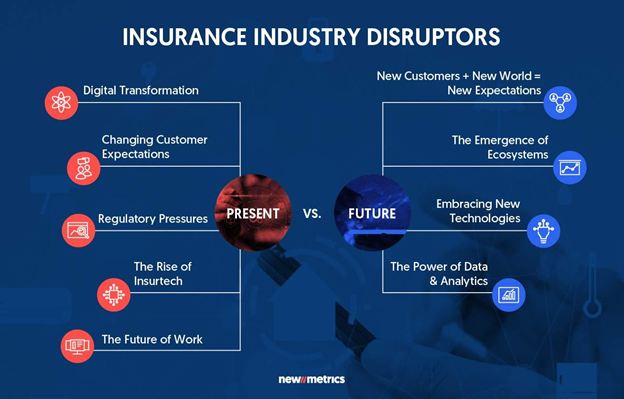

Source : The Future of the Insurance Industry

While the insurtech market presents vast opportunities, insurance startups face unique economic challenges that can impede their path to profitability. One of the primary hurdles is the capital-intensive nature of the insurance industry, which requires substantial upfront investments in technology, regulatory compliance, and risk management.

Moreover, insurtech startups often grapple with the complexities of pricing their products and services accurately, as they navigate the intricate web of risk assessment, actuarial calculations, and regulatory requirements. Striking the right balance between competitive pricing and profitability can be a delicate dance, especially in the early stages of a startup’s lifecycle.

Additionally, the insurance industry is heavily regulated, with stringent rules and guidelines governing various aspects of operations, from data privacy to consumer protection. Ensuring compliance with these regulations can be a significant financial burden for insurtech startups, potentially hampering their ability to allocate resources toward innovation and growth initiatives.

Key Technology Decisions for Insurtech Startups

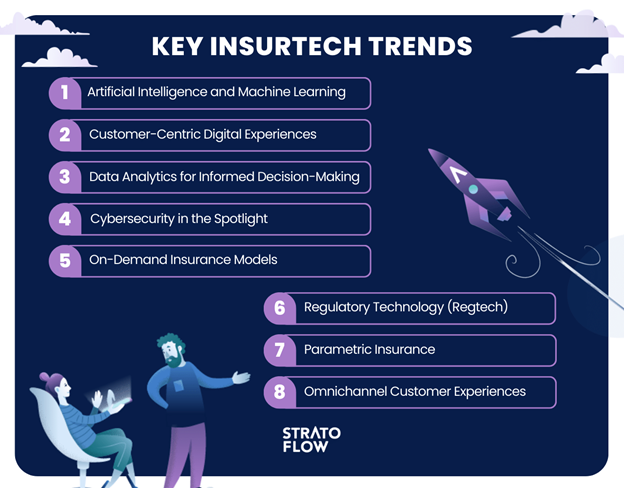

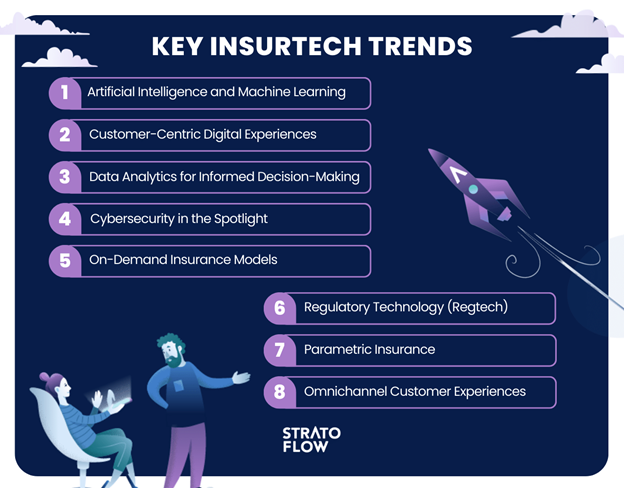

Source : The Future of Insurtech: Trends and Predictions

In the face of these economic challenges, insurtech startups must make strategic technology decisions that not only address operational efficiencies but also drive profitability. These decisions encompass a wide range of areas, from data management and analytics to artificial intelligence (AI) and process automation.

- Robust Data Infrastructure: Effective data management and analytics are critical for insurtech startups, as they enable accurate risk assessment, personalized product offerings, and informed decision-making. Investing in a scalable and secure data infrastructure, including cloud computing and data lakes, can provide a solid foundation for data-driven operations and unlock valuable insights.

- Agile Software Development: Adopting an agile software development approach allows insurtech startups to rapidly iterate and adapt to changing market conditions and customer needs. By leveraging modern software development methodologies, such as DevOps and continuous integration/continuous deployment (CI/CD), startups can accelerate time-to-market and respond swiftly to emerging trends and regulatory changes.

- Intelligent Automation: Automating repetitive and labor-intensive tasks through intelligent automation technologies, such as robotic process automation (RPA) and intelligent process automation (IPA), can significantly reduce operational costs and improve efficiency. These technologies can streamline processes like claims processing, underwriting, and customer onboarding, freeing up valuable resources and enabling faster turnaround times.

- Cloud Computing and Microservices Architecture: Embracing cloud computing and microservices architecture can provide insurtech startups with the scalability, flexibility, and cost-effectiveness they need to grow and adapt. Cloud-based solutions eliminate the need for expensive on-premises infrastructure, while microservices enable modular and independent deployment of application components, fostering agility and resilience.

- Cybersecurity and Regulatory Compliance: Prioritizing cybersecurity and regulatory compliance is crucial for insurtech startups, as they handle sensitive customer data and operate in a highly regulated environment. Investing in robust security measures, such as encryption, multi-factor authentication, and secure coding practices, can help mitigate risks and ensure compliance with data privacy and consumer protection regulations.

By making strategic technology decisions in these areas, insurtech startups can optimize their operations, enhance customer experiences, and ultimately drive profitability in a highly competitive and rapidly evolving market.

Leveraging Artificial Intelligence in Insurtech Startups

Source : Discover 5 Top AI Solutions impacting InsurTech Companies

Artificial Intelligence (AI) has emerged as a game-changer in the insurtech industry, offering unprecedented opportunities for innovation, efficiency, and profitability. By harnessing the power of AI, insurtech startups can unlock new revenue streams, streamline operations, and deliver personalized and data-driven experiences to their customers.

- Intelligent Underwriting: AI-powered underwriting solutions can revolutionize the risk assessment process by analyzing vast amounts of data, including customer profiles, historical claims data, and external data sources. This data-driven approach enables more accurate risk modeling, personalized pricing, and faster underwriting decisions, ultimately leading to improved profitability and customer satisfaction.

- Fraud Detection and Prevention: AI algorithms can be trained to identify patterns and anomalies in claims data, enabling insurtech startups to detect and prevent fraudulent activities more effectively. By reducing financial losses due to fraud, startups can improve their bottom line and maintain a competitive edge in the market.

- Personalized Product Offerings: AI-driven customer segmentation and predictive analytics can help insurtech startups tailor their product offerings to specific customer needs and preferences. By leveraging machine learning algorithms, startups can analyze customer data, identify patterns, and develop personalized insurance products that resonate with their target audience, increasing customer acquisition and retention rates.

- Chatbots and Virtual Assistants: AI-powered chatbots and virtual assistants can provide 24/7 customer support, streamlining the customer experience and reducing operational costs. These intelligent assistants can handle routine inquiries, provide personalized recommendations, and even guide customers through complex processes, such as claims filing or policy renewals, improving customer satisfaction and loyalty.

- Predictive Maintenance and Risk Mitigation: In industries like automotive and home insurance, AI can be leveraged for predictive maintenance and risk mitigation. By analyzing sensor data and historical patterns, AI models can identify potential issues or risks before they occur, enabling proactive maintenance and preventive measures, ultimately reducing claims and associated costs.

To fully harness the potential of AI, insurtech startups must invest in robust data infrastructure, secure high-performance computing resources, and foster a culture of data-driven decision-making. Additionally, addressing ethical concerns, such as algorithmic bias and data privacy, is crucial for building trust and ensuring responsible AI deployment.

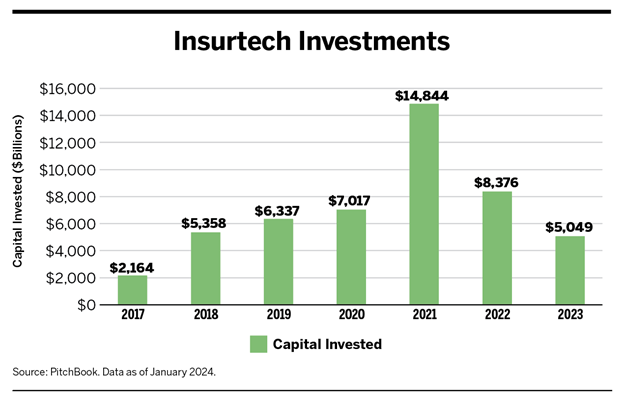

Shift in Investment Focus for Insurance Startups

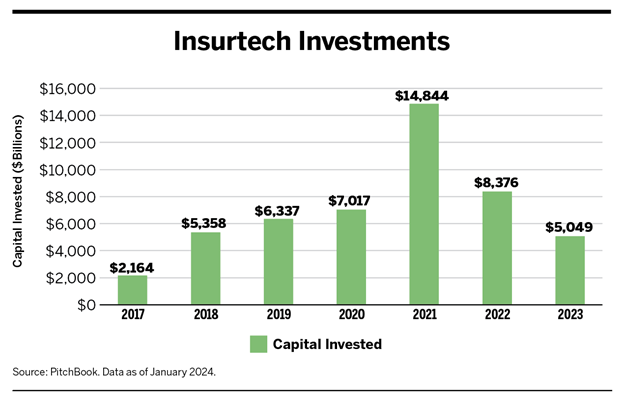

Source : Insurtechs Prioritize Profitability over Growth

As the insurtech landscape continues to evolve, a notable shift in investment focus has emerged. While early-stage insurtech startups primarily concentrated on disrupting the consumer-facing aspects of the insurance industry, such as digital distribution channels and customer engagement, the focus is now shifting towards backend operations and enterprise solutions.

This shift is driven by the realization that true profitability and scalability in the insurance industry lie in streamlining and optimizing core operational processes, such as underwriting, claims management, and risk assessment. Investors are increasingly recognizing the potential of startups that leverage advanced technologies to transform these backend operations, delivering efficiency, cost savings, and improved customer experiences.

- B2B SaaS Solutions: A growing number of insurtech startups are developing Software-as-a-Service (SaaS) solutions tailored for insurance carriers and brokers. These solutions aim to automate and optimize various aspects of insurance operations, such as policy administration, billing, and claims processing. By offering these solutions as a service, startups can tap into recurring revenue streams and establish long-term partnerships with insurance enterprises.

- Data Analytics and Risk Modeling: Startups specializing in data analytics and risk modeling are gaining traction, as insurance companies seek to leverage advanced data-driven techniques for better risk assessment, pricing, and underwriting decisions. These startups leverage machine learning, predictive modeling, and data visualization tools to provide insurers with actionable insights and competitive advantages.

- Cybersecurity and RegTech: With the increasing digitalization of the insurance industry and heightened regulatory scrutiny, startups offering cybersecurity and regulatory technology (RegTech) solutions are attracting significant investment. These solutions help insurers protect sensitive data, comply with evolving regulations, and mitigate risks associated with cyber threats and data breaches.

- Insurtech Enablers: A new breed of startups, known as insurtech enablers, is emerging. These companies provide the underlying infrastructure, APIs, and developer tools that empower other insurtech startups and traditional insurers to build and deploy innovative solutions more efficiently. By offering modular and scalable platforms, insurtech enablers are facilitating faster innovation and time-to-market for insurance products and services.

As the insurtech ecosystem matures, this shift in investment focus towards backend operations and enterprise solutions is expected to drive sustainable profitability and long-term growth for startups in the industry. By addressing the core operational challenges faced by insurance companies, these startups are positioning themselves as strategic partners and enablers of digital transformation within the insurance sector.

The Role of Data Analytics in Driving Profitability for Insurtech Startups

In the data-driven era, insurtech startups that effectively leverage data analytics have a significant competitive advantage in driving profitability and sustainable growth. Data analytics plays a pivotal role in various aspects of the insurance value chain, from risk assessment and pricing to customer acquisition and retention.

- Risk Modeling and Underwriting: Accurate risk modeling and underwriting are critical for insurtech startups to maintain profitability. By leveraging advanced data analytics techniques, such as machine learning and predictive modeling, startups can analyze vast amounts of structured and unstructured data to identify patterns, assess risks more precisely, and make informed underwriting decisions. This data-driven approach enables startups to price their products more accurately, mitigate potential losses, and optimize their risk portfolios.

- Customer Segmentation and Personalization: Data analytics empowers insurtech startups to gain deep insights into customer behavior, preferences, and risk profiles. By leveraging clustering algorithms and predictive analytics, startups can segment their customer base into distinct groups and tailor their product offerings, pricing strategies, and marketing campaigns accordingly. This personalized approach not only enhances customer satisfaction and loyalty but also increases cross-selling and upselling opportunities, driving revenue growth and profitability.

- Fraud Detection and Prevention: Insurance fraud is a significant threat to profitability, and data analytics plays a crucial role in combating this issue. By applying advanced analytics techniques, such as anomaly detection and pattern recognition, insurtech startups can identify potential fraudulent activities and implement preventive measures. This proactive approach helps mitigate financial losses, protect customer trust, and maintain a competitive edge in the market.

- Claims Management and Optimization: Efficient claims management is essential for insurtech startups to control costs and improve profitability. Data analytics can streamline the claims process by automating routine tasks, identifying potential bottlenecks, and optimizing resource allocation. Predictive analytics can also be used to forecast claim volumes and patterns, enabling startups to proactively manage their resources and minimize operational inefficiencies.

- Customer Retention and Lifetime Value: Data analytics plays a crucial role in understanding customer behavior, identifying churn risks, and implementing targeted retention strategies. By analyzing customer data, such as usage patterns, feedback, and interactions, insurtech startups can predict customer churn and take proactive measures to retain valuable customers. Additionally, by optimizing customer lifetime value (CLV), startups can prioritize their resources and investments towards the most profitable customer segments, further enhancing profitability.

To fully leverage the power of data analytics, insurtech startups must invest in robust data infrastructure, skilled data science teams, and advanced analytical tools. Additionally, fostering a data-driven culture within the organization and ensuring data governance and privacy compliance are essential for successful data analytics initiatives.

B2B SaaS Solutions for Insurance Firms

Source : SaaS in the Insurance Industry

As the insurtech landscape continues to evolve, a growing number of startups are focusing on developing Business-to-Business (B2B) Software-as-a-Service (SaaS) solutions tailored specifically for insurance firms. These solutions aim to streamline and automate various aspects of insurance operations, from underwriting and policy administration to claims management and customer engagement.

- Underwriting Automation: Insurtech startups are developing SaaS solutions that leverage artificial intelligence (AI) and machine learning (ML) to automate the underwriting process. These solutions can analyze vast amounts of data, including customer profiles, historical claims data, and external data sources, to provide accurate risk assessments and pricing recommendations. By automating this traditionally manual and time-consuming process, insurance firms can improve efficiency, reduce operational costs, and enhance customer experiences.

- Policy Administration Systems: Policy administration systems (PAS) are essential for insurance firms to manage the entire lifecycle of insurance policies, from issuance to renewal or cancellation. Insurtech startups are offering cloud-based PAS solutions that provide a centralized platform for policy management, enabling real-time updates, seamless integration with other systems, and improved data accessibility. These solutions can streamline policy administration processes, reduce errors, and enhance overall operational efficiency.

- Claims Management Solutions: Efficient claims management is crucial for insurance firms to maintain profitability and customer satisfaction. Insurtech startups are developing SaaS solutions that leverage AI and automation to streamline the claims process, from initial filing to adjudication and settlement. These solutions can automate routine tasks, detect potential fraud, and provide real-time visibility into claims status, ultimately reducing processing times and improving customer experiences.

- Customer Engagement Platforms: In today’s digital age, insurance firms must provide seamless and personalized customer experiences across multiple channels. Insurtech startups are offering customer engagement platforms that leverage AI-powered chatbots, virtual assistants, and omnichannel communication capabilities. These solutions enable insurance firms to provide 24/7 customer support, personalized recommendations, and proactive outreach, enhancing customer satisfaction and loyalty.

- Data Analytics and Reporting: Data-driven decision-making is crucial for insurance firms to gain competitive advantages and drive profitability. Insurtech startups are developing SaaS solutions that offer advanced data analytics and reporting capabilities, enabling insurance firms to analyze customer data, identify trends and patterns, and generate actionable insights. These solutions can help firms optimize pricing strategies, mitigate risks, and make informed business decisions.

By adopting these B2B SaaS solutions, insurance firms can benefit from increased operational efficiency, reduced costs, improved customer experiences, and enhanced profitability. However, it is essential for insurance firms to carefully evaluate and select the right solutions that align with their specific business requirements, regulatory compliance needs, and long-term strategic goals.

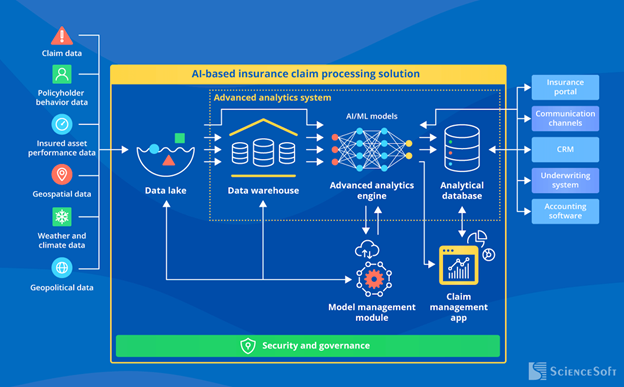

Optimizing Onboarding and Claims with AI

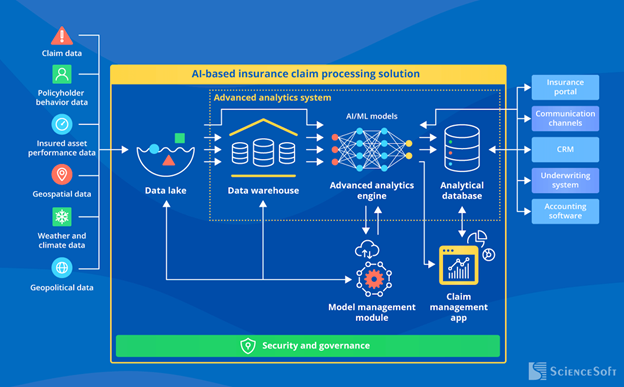

Source : The Market of AI for Insurance Claims

Artificial Intelligence (AI) has emerged as a powerful tool for insurtech startups to optimize critical processes such as customer onboarding and claims management. By leveraging AI technologies, startups can streamline these processes, enhance customer experiences, and drive profitability.

- Intelligent Onboarding: The customer onboarding process is often a crucial touchpoint that shapes the initial impression and experience of a customer with an insurance provider. Insurtech startups are leveraging AI-powered solutions to streamline and personalize this process. For instance, AI-driven chatbots and virtual assistants can guide customers through the application process, answering queries, and collecting necessary information in a conversational and user-friendly manner. Additionally, AI algorithms can analyze customer data, identify patterns, and recommend tailored insurance products based on individual needs and preferences, enhancing customer satisfaction and increasing conversion rates.

- Automated Underwriting: Traditional underwriting processes can be time-consuming and prone to human errors. AI-powered underwriting solutions can revolutionize this process by analyzing vast amounts of data, including customer profiles, historical claims data, and external data sources. Machine learning algorithms can identify patterns and correlations, enabling more accurate risk modeling, personalized pricing, and faster underwriting decisions. This data-driven approach not only improves operational efficiency but also enhances profitability by minimizing potential losses and optimizing risk portfolios.

- Claims Processing Automation: Claims processing is a critical aspect of the insurance value chain, and inefficiencies in this process can lead to customer dissatisfaction and financial losses. Insurtech startups are leveraging AI technologies to automate various stages of the claims process, from initial filing to adjudication and settlement. AI-powered solutions can extract relevant information from claim documents, cross-reference data sources, and identify potential fraud or anomalies. Additionally, AI-driven decision support systems can assist claims handlers in making informed decisions, reducing processing times and improving accuracy.

- Predictive Maintenance and Risk Mitigation: In industries like automotive and home insurance, AI can be leveraged for predictive maintenance and risk mitigation. By analyzing sensor data, historical patterns, and external factors (such as weather conditions), AI models can identify potential issues or risks before they occur. This proactive approach enables insurers to recommend preventive measures or schedule timely maintenance, ultimately reducing the likelihood of claims and associated costs.

- Personalized Customer Experiences: AI-powered solutions can also enhance customer experiences throughout the insurance journey. Chatbots and virtual assistants can provide 24/7 support, answering queries, and guiding customers through complex processes like claims filing or policy renewals. Additionally, AI-driven personalization can tailor communication, product recommendations, and service offerings based on individual customer preferences and behavior, fostering loyalty and increasing customer lifetime value.

To fully harness the potential of AI in optimizing onboarding and claims processes, insurtech startups must invest in robust data infrastructure, secure high-performance computing resources, and foster a culture of data-driven decision-making. Additionally, addressing ethical concerns, such as algorithmic bias and data privacy, is crucial for building trust and ensuring responsible AI deployment.

Insurtech startups that successfully leverage AI to streamline onboarding and claims processes can gain significant competitive advantages. These include improved operational efficiency, reduced costs, enhanced customer experiences, and ultimately, increased profitability. However, it is essential to approach AI implementation with a strategic mindset, aligning it with the overall business objectives and ensuring seamless integration with existing systems and processes.

Challenges in AI Infrastructure and Hardware

While the transformative potential of Artificial Intelligence (AI) in the insurtech industry is undeniable, implementing and scaling AI solutions presents unique challenges, particularly in terms of infrastructure and hardware requirements. As insurtech startups strive to leverage AI for various applications, addressing these challenges becomes crucial for ensuring efficient and cost-effective operations.

- Computational Power: AI algorithms, especially those involving deep learning and neural networks, are computationally intensive and require significant processing power. Insurtech startups may need to invest in high-performance computing (HPC) resources, such as powerful graphics processing units (GPUs) or specialized AI accelerators, to train and run their AI models efficiently. This can be a significant upfront cost and may require specialized expertise in hardware configuration and optimization.

- Data Storage and Management: AI models rely on vast amounts of data for training and inference. Insurtech startups must have robust data storage and management solutions in place to handle the large volumes of structured and unstructured data generated from various sources, such as customer interactions, claims data, and external data feeds. This may involve investing in scalable data lakes, distributed file systems, and efficient data pipelines to ensure seamless data ingestion, processing, and retrieval.

- Cloud Infrastructure: While on-premises infrastructure can be an option, many insurtech startups are leveraging cloud computing services to meet their AI infrastructure needs. Cloud providers offer scalable and on-demand compute resources, as well as pre-configured AI platforms and tools. However, managing cloud infrastructure effectively requires expertise in areas such as resource provisioning, cost optimization, and security and compliance considerations.

- Model Deployment and Monitoring: Once AI models are developed and trained, deploying them into production environments and monitoring their performance can be challenging. Insurtech startups need to implement robust model deployment pipelines, ensuring seamless integration with existing systems and applications. Additionally, monitoring model performance, detecting drift or degradation, and implementing continuous learning and retraining processes are essential for maintaining the accuracy and relevance of AI solutions.

- Talent and Expertise: Developing and maintaining AI infrastructure and hardware solutions requires specialized expertise in areas such as data engineering, machine learning engineering, and DevOps. Insurtech startups may face challenges in attracting and retaining talent with the necessary skills, as competition for AI professionals remains intense across various industries.

To overcome these challenges, insurtech startups can explore partnerships with cloud providers, hardware vendors, or specialized AI service providers. Additionally, adopting a modular and scalable architecture, leveraging open-source tools and frameworks, and fostering a culture of continuous learning and innovation can help startups stay ahead of the curve in the rapidly evolving AI landscape.

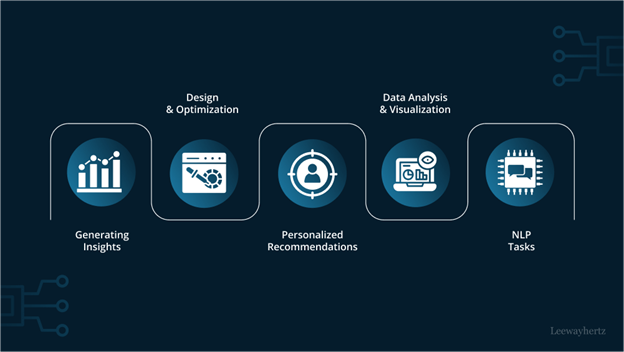

Internal Process Automation with GenAI

Source : Generative AI automation: Use cases, benefits and real world applications

In the pursuit of operational efficiency and profitability, insurtech startups are increasingly turning to Generative Artificial Intelligence (GenAI) to automate internal processes and streamline workflows. GenAI, which encompasses technologies like natural language processing (NLP), computer vision, and generative models, offers insurtech startups the ability to automate a wide range of tasks, from document processing and data entry to content generation and customer support.

- Intelligent Document Processing: Insurtech startups often deal with a high volume of documents, such as insurance applications, claims forms, and policy documents. GenAI solutions can automate the extraction, classification, and processing of information from these documents, reducing the need for manual data entry and minimizing errors. For example, NLP models can be trained to understand the context and structure of insurance documents, enabling accurate data extraction and intelligent routing.

- Automated Content Generation: Content creation is an essential aspect of insurtech operations, from marketing materials and product descriptions to customer communications and regulatory reports. GenAI models can assist in generating high-quality content efficiently, saving time and resources. For instance, language models can be fine-tuned to generate personalized policy summaries, tailored marketing copy, or even draft responses to customer inquiries, streamlining content creation processes.

- Conversational AI and Customer Support: Chatbots and virtual assistants powered by GenAI can provide 24/7 customer support, handling routine inquiries, providing personalized recommendations, and guiding customers through complex processes like claims filing or policy renewals. By leveraging NLP and conversational AI, these solutions can understand natural language inputs, maintain context, and provide human-like responses, enhancing customer experiences while reducing operational costs.

- Intelligent Automation and Workflow Management: GenAI can be integrated into workflow management systems to automate and optimize internal processes. For example, NLP models can be trained to understand and categorize incoming requests, automatically routing them to the appropriate teams or triggering specific actions based on predefined rules. This intelligent automation can significantly reduce manual effort, minimize errors, and accelerate turnaround times.

- Data Augmentation and Synthetic Data Generation: In the insurance industry, access to high-quality and diverse data is crucial for training AI models effectively. GenAI techniques, such as generative adversarial networks (GANs) and diffusion models, can be used to generate synthetic data that resembles real-world scenarios. This data augmentation approach can help insurtech startups overcome data scarcity challenges and improve the performance and generalization of their AI models.

While implementing GenAI solutions can bring significant benefits, insurtech startups must address potential challenges, such as ensuring data privacy and security, mitigating algorithmic biases, and maintaining transparency and explainability in AI-driven decision-making processes. Additionally, fostering a culture of continuous learning and upskilling employees in GenAI technologies will be crucial for successful adoption and integration.

Insurtech startups seeking to drive profitability through technology decisions can partner with AI experts like Anthropic. Our team of experienced professionals can assist you in navigating the complex landscape of AI and GenAI solutions, ensuring seamless integration, scalability, and compliance with industry regulations. Contact us today to explore how we can help you unlock the full potential of AI and GenAI for your insurtech business.

In conclusion, the power of technology decisions cannot be overstated in driving profitability for insurtech startups. By leveraging cutting-edge technologies such as AI, GenAI, data analytics, and process automation, startups can streamline operations, enhance customer experiences, and gain a competitive edge in the rapidly evolving insurance landscape. However, successful implementation requires a strategic approach, addressing challenges related to infrastructure, talent, and ethical considerations. Insurtech startups that prioritize intelligent technology decisions will be well-positioned to thrive and achieve long-term profitability in this dynamic and innovative industry.