Simplifying the Claim Submission Process through Self-serve Portals

Hi *|FNAME|*

In this newsletter, we learn about self-serve portals and explore how they revolutionize the claims experience for businesses and customers. We’ll showcase how companies utilize these portals to simplify claim submissions, improve customer satisfaction, and boost operational efficiency.

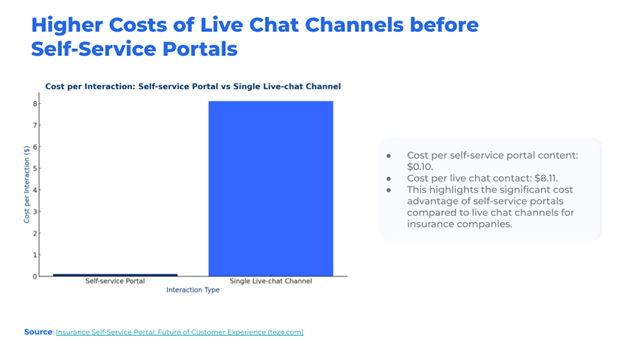

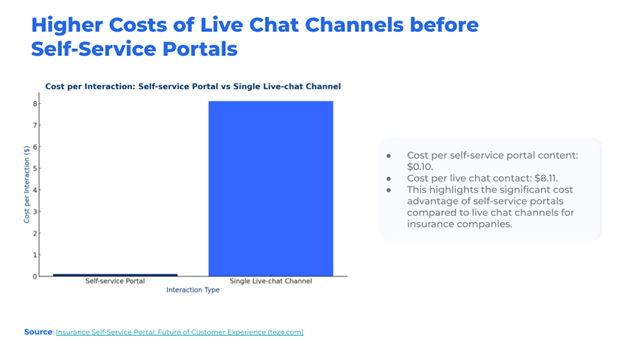

Higher Costs of Live Chat Channels Before Self-Service Portals

Traditional claims processing can be slow and error-prone, with higher costs for live chat channels.

- Cost per Live Chat Channel: A single live chat channel content costs $8.11, which is a higher cost for both clients and insurers.

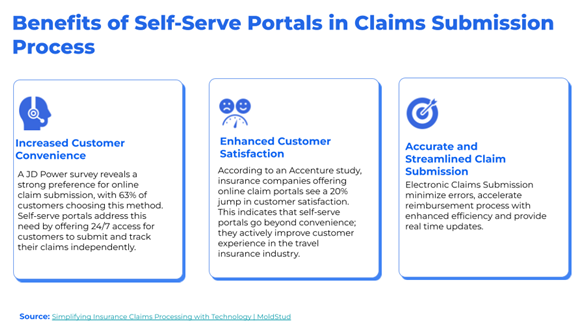

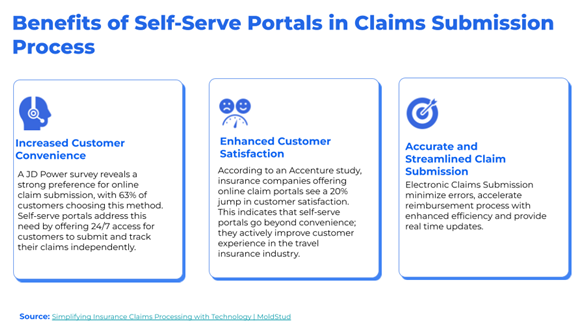

Benefits of Self-serve Portals in the Claims Submission Process

Increased Efficiency and Convenience: Self-service portals can automate many of the tasks associated with claims processing, freeing up your team to focus on more complex claims and bringing convenience to the customers.

Streamlined Claims: Electronic claim submission helps streamline and accurately claim submission with faster processing times.

Improved Customer Satisfaction: Self-serve portals bring a 20% increase customer satisfaction. Customers appreciate the convenience and transparency of self-service portals.

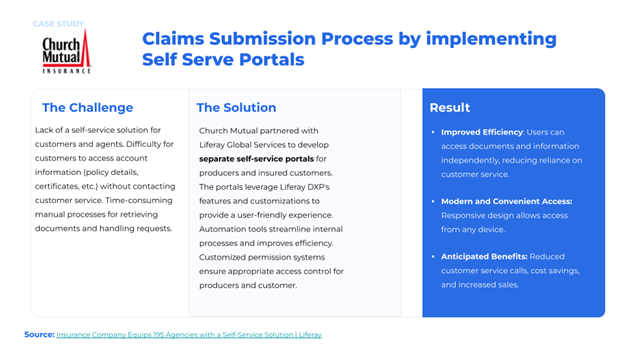

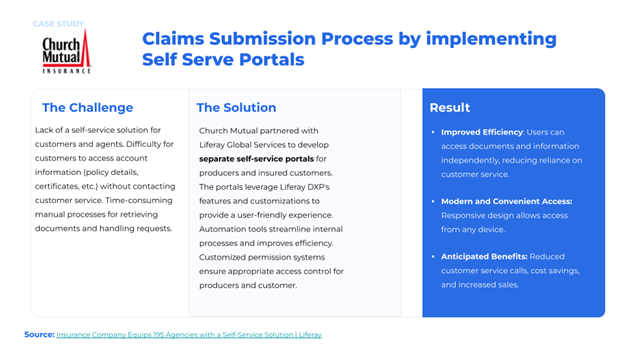

Case Study:

Challenge

Church Mutual faced a challenge with its claims submission process. Customers and agents lacked a self-service solution to access account information and documents, leading to time-consuming manual processes and reliance on customer service.

Solution

Church Mutual partnered with Life Ray Global Services to develop self-service portals for producers and insured customers. These portals leverage Life Ray DXP’s features to provide a user-friendly experience and include automation tools to streamline internal processes.

Result

The implementation resulted in:

- Rapid adoption by producers

- Improved efficiency through user self-service and automation

- Modern and convenient access for users through any device

- Anticipated benefits include reduced customer service calls, cost savings, and increased sales.

Lea: An AI-powered Digital Native Travel Insurance Claims Solution

Meet Lea, an AI-powered Digital Native Travel Insurance Claims Solution designed to simplify and enhance travel insurance claims processing.

Lea is designed around seven key modules:

- Online Claim Submission: Our user-friendly online portal guides claimants through the process, ensuring all required information is captured upfront. This reduces back-and-forth communication, saving time for both the claimant and the claim handlers.

- Centralized Collaborations Claims Hub: All claim details, documents, and communication are organized in a single, editable workspace. This fosters seamless collaboration and allows anyone on the team to quickly understand the claim status.

- Automated Claim Assessment powered by AI: LEA integrates rule-based management, document verification, and fraud validation to swiftly make automated, real-time decisions on claims. This functionality frees up valuable time for your claims examiners to concentrate on complex cases, offering personalized attention to customers.

- Customer Self-Serve Policy Management: Provide your customers control with a self-service portal where they can access policy details, update information, and manage their coverage independently.

- Omni-channel Customer Service: Deliver exceptional customer care through diverse channels, ensuring constant connectivity and support for your customers.

- Outbound Customer Engagement: Proactively reach out to your customers, keeping them informed and engaged throughout the claims process.

- Advanced Claim Analytics: Extract valuable insights from data to identify trends, optimize operations, and make informed decisions. These insights enable your claims team to pinpoint improvement areas, allocate resources effectively, and enhance the efficiency and effectiveness of the claims process.

[Contact us to learn more]