Image Source: Pexels

Understanding the concept of ROI in the insurance industry

Return on Investment (ROI) is a crucial metric that measures the profitability of an investment or project by comparing the net benefits or gains against the costs incurred. In the insurance industry, ROI analysis plays a pivotal role in evaluating the effectiveness of implementing new technologies, such as insurtech solutions. By quantifying the financial impact of these innovations, insurance companies can make informed decisions and ensure that their investments yield positive returns.

ROI analysis in the insurance sector considers various factors, including operational efficiency gains, cost savings, revenue growth, and customer satisfaction improvements. It helps insurance companies justify the allocation of resources towards technological advancements and assess the long-term viability of such initiatives.

Moreover, ROI analysis serves as a valuable tool for tracking the progress and success of insurtech implementations, enabling data-driven decision-making and continuous improvement.

Benefits of implementing new insurance technologies

Source : Insurance digital transformation: (r)evolution in the industry

The adoption of new insurance technologies, commonly referred to as insurtech, offers numerous benefits that can positively impact an insurance company’s bottom line and overall competitiveness. Some of the key advantages include:

- Streamlined Operations: Insurtech solutions can automate and optimize various processes, such as underwriting, claims processing, and customer onboarding, leading to increased operational efficiency and cost savings.

- Enhanced Customer Experience: By leveraging technologies like mobile apps, chatbots, and data analytics, insurtech enables personalized and seamless customer interactions, improving satisfaction and retention rates.

- Data-Driven Decision Making: Advanced analytics and predictive modeling tools empower insurance companies to make data-driven decisions, mitigate risks, and identify new business opportunities.

- Product Innovation: Insurtech facilitates the development of innovative products and services tailored to evolving customer needs, enabling insurance companies to stay competitive and tap into new revenue streams.

- Improved Risk Management: Technologies like telematics, IoT devices, and AI-powered risk assessment tools enhance risk monitoring and mitigation capabilities, potentially reducing claims and associated costs.

Key considerations for maximizing ROI in insurtech

To maximize the ROI of insurtech implementations, insurance companies must consider several critical factors:

- Strategic Alignment: Ensure that the chosen insurtech solutions align with the company’s overall business strategy, objectives, and long-term goals.

- Scalability and Integration: Evaluate the scalability and compatibility of the new technologies with existing systems and processes to facilitate seamless integration and future growth.

- Data Quality and Management: Implement robust data management practices to ensure the accuracy, completeness, and security of data, which is essential for deriving meaningful insights and optimizing processes.

- Change Management: Develop a comprehensive change management strategy to facilitate a smooth transition, address potential resistance, and foster user adoption.

- Continuous Monitoring and Optimization: Regularly monitor and analyze the performance of the implemented technologies, making necessary adjustments and optimizations to maximize their impact and ROI.

Case studies: Successful implementation of insurtech

Source : TEN Trends Transforming Insurtech in 2024 and Beyond

To illustrate the potential benefits and ROI of implementing insurtech solutions, let’s explore a few real-world case studies:

- Automated Underwriting: A leading insurance company implemented an AI-powered underwriting system, reducing the time and resources required for risk assessment and policy issuance. This resulted in a 30% decrease in operational costs and a 20% increase in customer acquisition rates.

- Telematics-Based Auto Insurance: An auto insurance provider introduced a usage-based insurance (UBI) program leveraging telematics technology. By monitoring driving behavior and adjusting premiums accordingly, the company experienced a 15% reduction in claims costs and a 25% increase in customer retention rates.

- Chatbot for Customer Service: A major insurer deployed an AI-driven chatbot to handle routine customer inquiries and support requests. This initiative led to a 40% decrease in call center volumes, reduced wait times, and improved customer satisfaction scores by 18%.

Challenges and risks associated with implementing new insurance technologies

While the potential benefits of insurtech are significant, insurance companies must also consider and mitigate the associated challenges and risks:

- Data Privacy and Security: Handling sensitive customer data and adhering to strict regulatory requirements necessitate robust data governance and cybersecurity measures.

- Legacy System Integration: Integrating new technologies with existing legacy systems can be complex and costly, potentially hindering the seamless adoption of insurtech solutions.

- User Adoption and Change Management: Overcoming resistance to change and ensuring user adoption among employees and customers is crucial for the successful implementation of new technologies.

- Regulatory Compliance: Insurance companies must navigate a complex regulatory landscape and ensure that their insurtech initiatives comply with relevant laws and regulations.

- Vendor Management: Reliance on third-party vendors and service providers for insurtech solutions introduces potential risks related to vendor performance, data security, and contractual obligations.

Key metrics for measuring ROI in insurtech

Source : 28 Best Insurance KPIs and Metrics Examples for 2024 Reporting

To accurately assess the ROI of insurtech implementations, insurance companies should track and analyze the following key metrics:

- Cost Savings: Monitor reductions in operational costs, such as underwriting expenses, claims processing costs, and customer service overheads.

- Revenue Growth: Measure increases in premiums, new customer acquisitions, and cross-selling opportunities resulting from improved products and services.

- Operational Efficiency: Track improvements in process cycle times, resource utilization, and productivity gains enabled by automation and streamlining.

- Customer Satisfaction and Retention: Evaluate metrics like customer satisfaction scores, net promoter scores (NPS), and customer churn rates to gauge the impact on customer experience and loyalty.

- Risk Mitigation: Analyze reductions in claims costs, fraud detection rates, and overall risk exposure due to enhanced risk management capabilities.

Tools and software for tracking and analyzing ROI in insurtech

To effectively track and analyze the ROI of insurtech initiatives, insurance companies can leverage various tools and software solutions:

- Business Intelligence (BI) and Analytics Tools: Platforms like Tableau, Power BI, and Qlik Sense enable data visualization, reporting, and advanced analytics capabilities for monitoring key performance indicators (KPIs) and ROI metrics.

- Project Management Software: Tools like Jira, Trello, and Asana help manage and track the progress of insurtech implementation projects, enabling better resource allocation and cost control.

- Customer Relationship Management (CRM) Systems: CRM platforms like Salesforce and Dynamics 365 provide valuable insights into customer data, interactions, and satisfaction levels, contributing to ROI analysis.

- Process Mining and Automation Tools: Solutions like UiPath and Celonis help identify process inefficiencies, automate tasks, and optimize workflows, directly impacting operational efficiency and cost savings.

- Risk Management Software: Specialized risk management tools, such as RiskCloud and Riskonnect, offer advanced risk modeling, monitoring, and reporting capabilities, supporting risk mitigation efforts and associated cost savings.

Future trends and opportunities in the insurtech industry

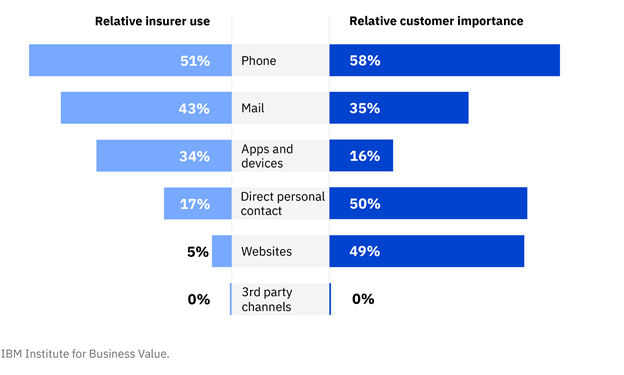

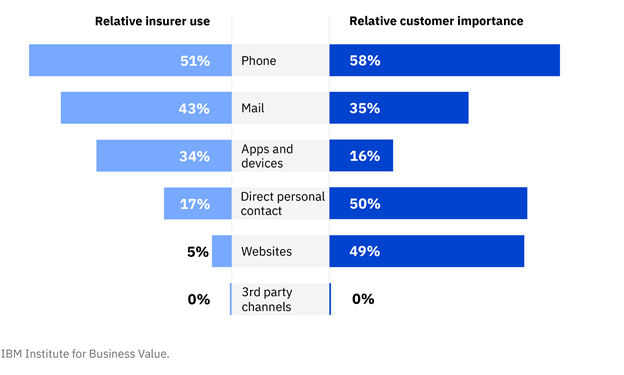

Source : Elevating the insurance customer experience

The insurtech industry is rapidly evolving, and insurance companies must stay ahead of emerging trends and opportunities to maintain a competitive edge and maximize their ROI:

- Artificial Intelligence and Machine Learning: The increasing adoption of AI and ML technologies will drive innovation in areas like predictive analytics, fraud detection, and personalized product offerings.

- Internet of Things (IoT) and Telematics: The proliferation of connected devices and telematics solutions will enable more accurate risk assessment, usage-based pricing models, and proactive claims management.

- Open Insurance and Ecosystems: The rise of open insurance platforms and ecosystems will facilitate collaboration, data sharing, and the development of innovative products and services across the insurance value chain.

- Embedded Insurance: The integration of insurance offerings into other products and services, such as e-commerce platforms, transportation services, and smart home devices, will create new revenue streams and customer acquisition opportunities.

Conclusion: The importance of ROI analysis in making informed decisions about implementing new insurance technologies

In the insurance industry, insurtech is crucial for companies to stay competitive, optimize operations, and enhance customer experiences. However, implementing new technologies requires significant investments. Conducting thorough ROI analyses is essential to ensure positive returns and informed decision-making. ROI analysis involves evaluating the financial impact, operational efficiencies, revenue growth potential, and customer satisfaction improvements enabled by insurtech solutions. By quantifying these benefits and comparing them against costs, insurance companies can allocate resources, prioritize initiatives, and measure success. ROI analysis also enables continuous monitoring, optimization, and data-driven decision-making. As the insurance industry embraces digital transformation, rigorous ROI analyses become even more important. By leveraging the right tools, metrics, and best practices, insurance companies can navigate insurtech adoption, mitigate risks, and drive profitability, customer satisfaction, and sustainable growth. Schedule a consultation with our experts to learn more about maximizing ROI and staying ahead in the insurance landscape. Our solutions and strategies empower informed decisions, seamless technology implementation, and long-term success.