Insurer-bank partnerships are thriving so much that the industry has come up with its ship name – Bancassurance. Simply defined, bancassurance is when banks and insurers (regardless of whether they’re in-house or external providers) work together to provide insurance products and services to the bank’s customer base.

Source: The Bankers Fun’s Facebook

The story of the affair between the two started with and remains most popular among credit protection products. This type of insurance pays out your mortgage or loan balance in the event of death, disability, job loss or critical illness. For that extra layer of guarantee on their money, it makes logical sense for banks to get involved in the insurance business. But the range of products that banks deal with today have expanded ever since to include life, health, savings, and even travel insurance among others.

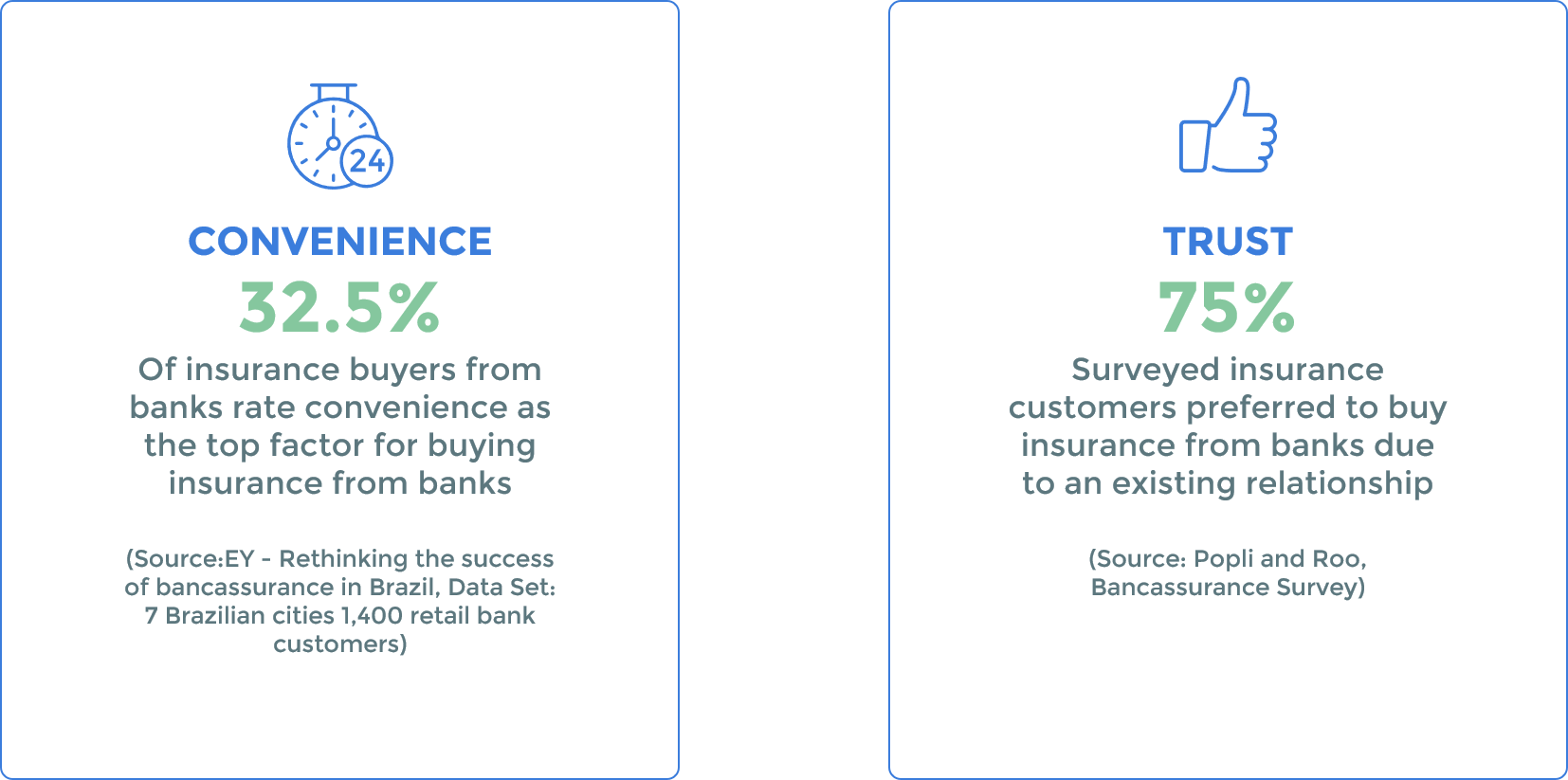

Whether it’s to keep money safe or to get a loan, most of us would go to banks in the first instance as a one-stop-shop to address our financial needs. And for the longest time, traditional banks have enjoyed higher levels of consumer trust relative to its insurance counterparts. That said, the tie-up between banks and insurers can create a win-win situation by increasing both of their revenue streams. Also for the customer when it comes to greater convenience and protection on their loans and savings.

Source: Advantages of Bancassurance for Customers, Banks, and Insurance Carriers by Meenu Joshi

Market research publisher, QY Research, estimates the global bancassurance market size to reach (USD 2249 million by 2026, from USD 2009 million in 2020, at a CAGR of 1.9% during 2021-2026.)

By region, Europe is expected to hold the largest market share which is estimated at about 39% in 2018 and this dominance is accounted for by the increasing investment from European banks. North America and the Asia-Pacific region are expected to hold a market share of 25% and 13%, respectively. Life insurance products continue to thrive in bancassurance partnerships which tend to have higher average selling prices than most non-life products.

China holds the lion’s share (⅔) of the bancassurance market growth in Asia-Pacific. Banks are incentivized to diversify their revenue in the face of decreasing net interest margins. As for Latin America, bancassurance growth is accounted for by the rise in per-capita GDP and more disposable income for individuals to buy insurance products.

Source: Advantages of Bancassurance for Customers, Banks, and Insurance Carriers by Meenu Joshi

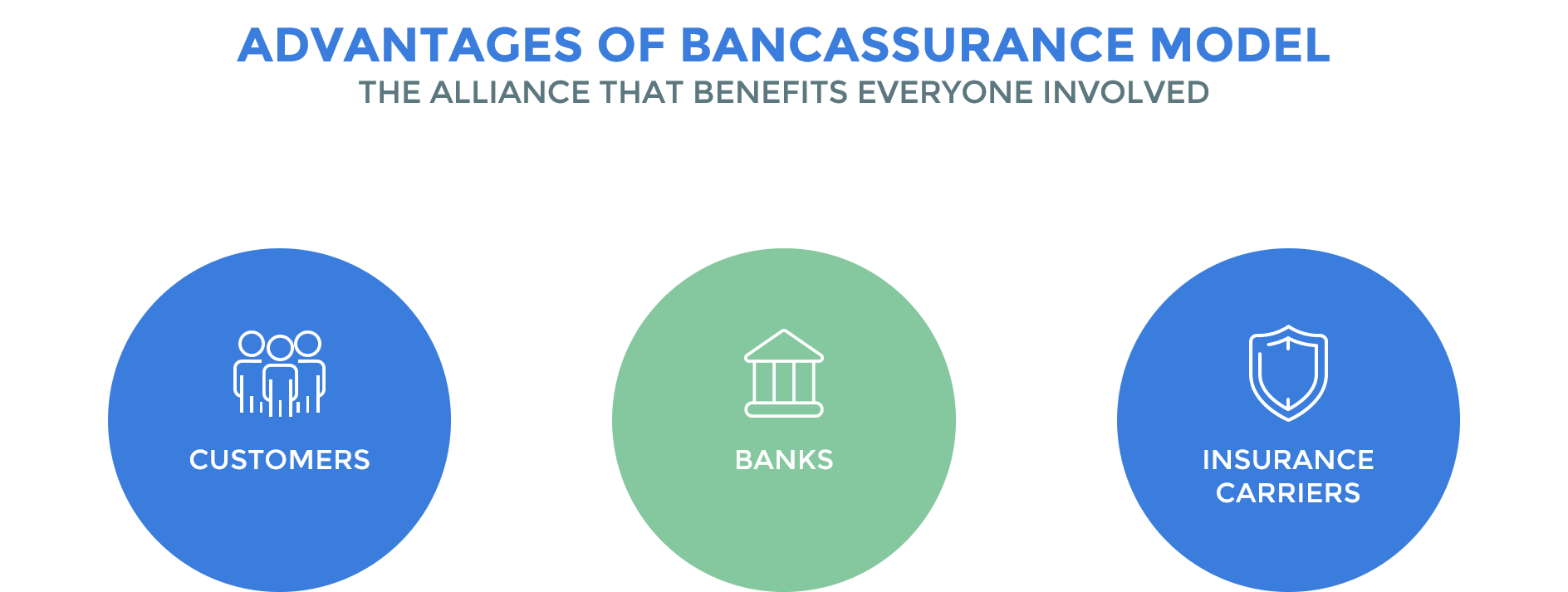

For banks:

For insurers:

For customers:

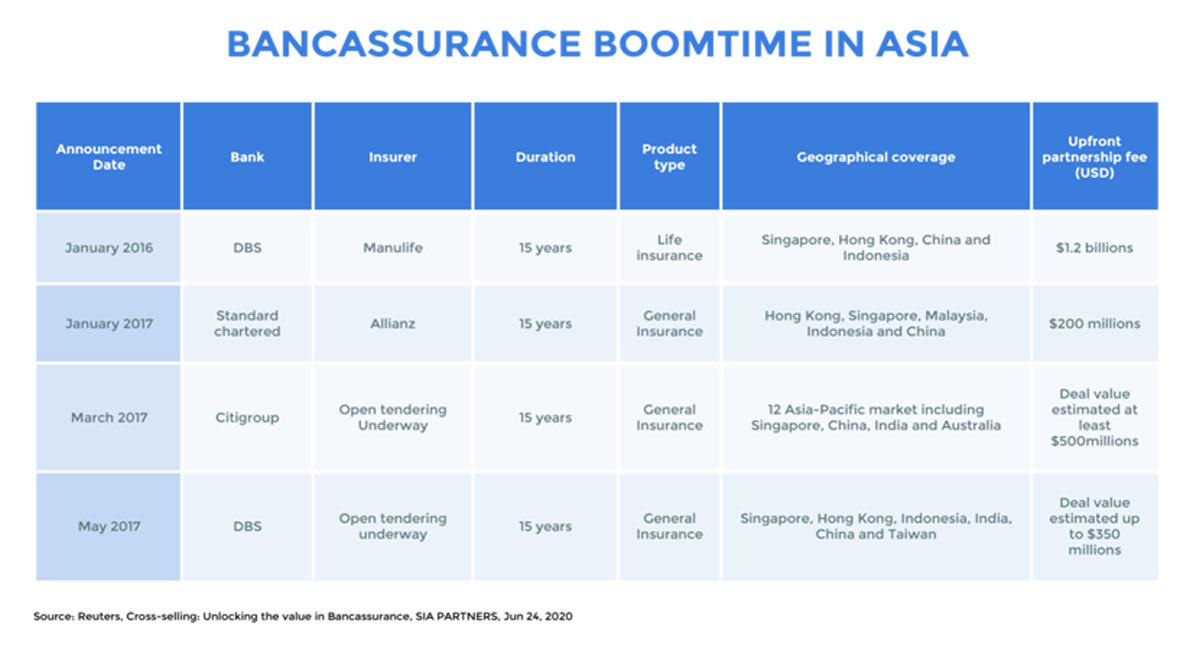

Source: Cross-selling: Unlocking the value in Bancassurance, SIAPARTNERS, Jun 24, 2020

According to SIAPARTNERS in 2020, bancassurance distribution deal size in the region is expected to soon exceed US$2.25 billion since 2016. A number of factors are at play here unique to Asia that are driving the growth of bancassurance in this region.

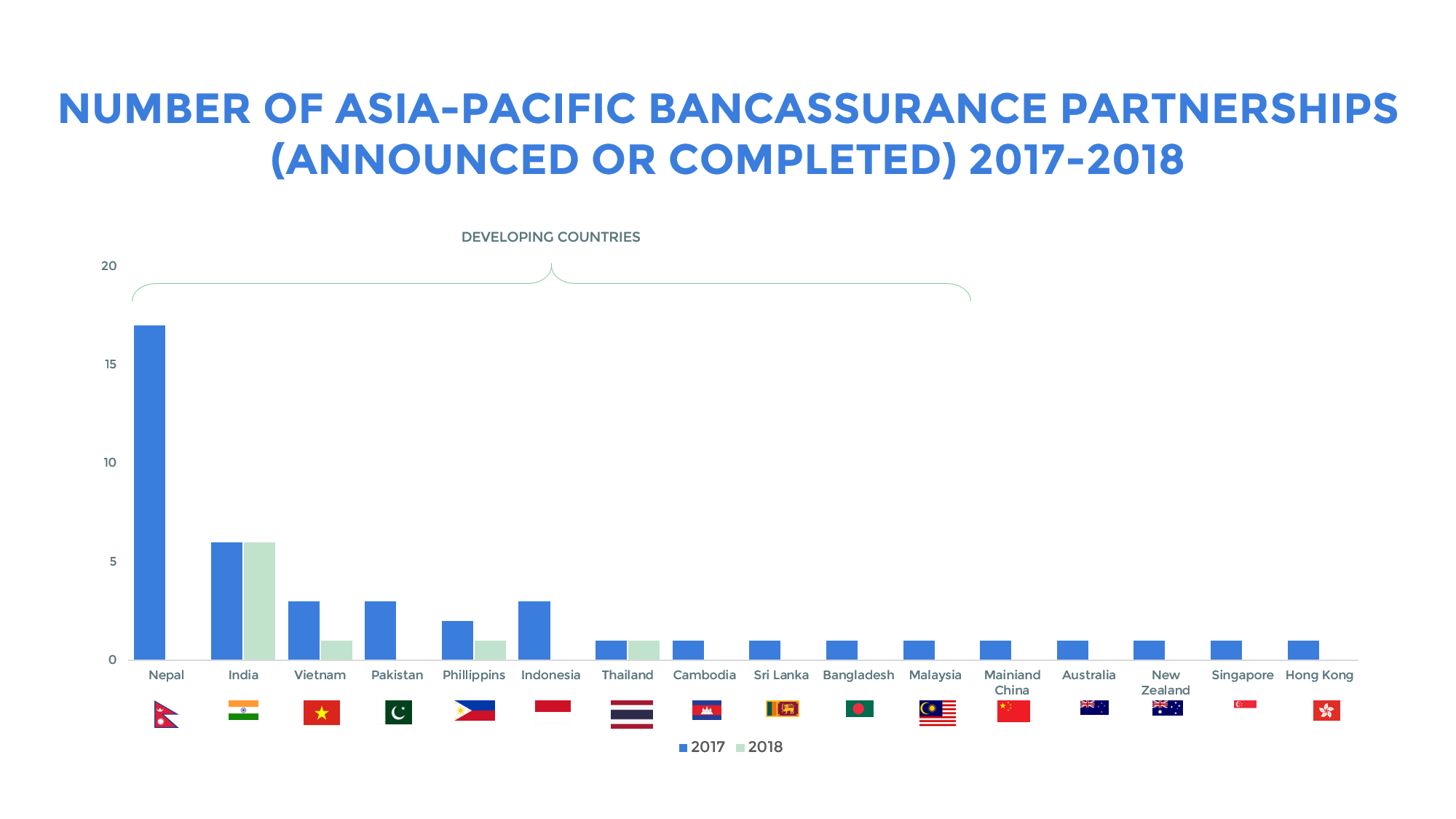

One of which is to gain access to developing/rural areas which traditionally have been largely untapped by insurers. FALIA Bancassurance Survey 2016 among 30 private insurers in Asia-Pacific (APAC) provides an insight of insurers forming bancassurance agreements to gain access into the distribution of local banks, especially in Nepal and India.

Source: Making the Most of Asia-Pacific’s Insurance Boom by Bain & Company

The other one is the trend towards deregulation of bancassurance to boost insurance penetration rates in the population. However, there has been swings back and forth in a number of countries to strengthen market conduct, especially at the front of customer data privacy.

We know of Asia as incredibly diverse, even within countries like India and China. That said, it can be challenging for insurers to build networks from scratch and they may want to take advantage of mature distribution channels like a bank’s local expertise and knowledge in a particular town or province.

The above-mentioned factors alongside a rising middle class population, a large population enabling economies of scale and youthful demographics in the developing countries will spur growth in bancassurance in the APAC region.

Important to note is that most of the insurers and/or banks involved in bancassurance in APAC have taken IT strategies. This could be attributed to the high rates of internet penetration in the region. Therefore, it’s quintessential for insurers and banks to constantly explore new technologies and rope them in to adapt and stay ahead of customers’ ever-changing needs.

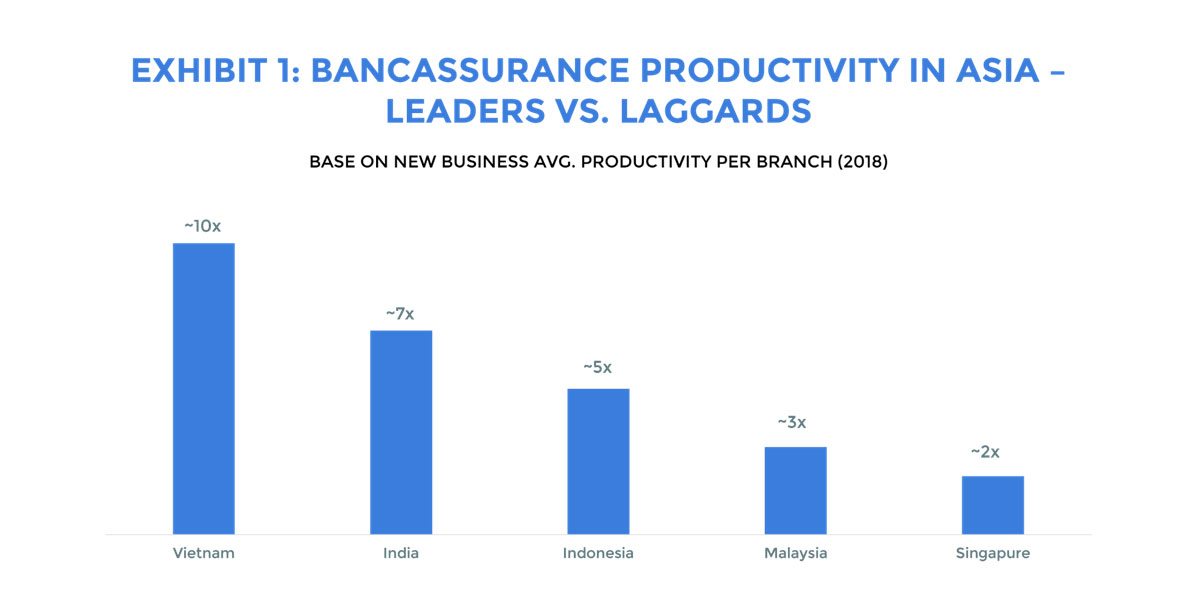

According to the graph below, analysis of bancassurance productivity in several Asian markets reveals that productivity gaps range from -2x to -10x, as compared to the median players where the gap ranges from -1.5x to -4x. While many factors can influence this, the overall trend shows that there are areas for vast improvement in the sector.

Source:https://www.oliverwyman.com/our-expertise/insights/2020/mar/bancassurance-in-asia.html

We want to try to find a common agenda for both banks and insurers to work together and take flight together. As it’s been reiterated, carriers like banks have a goal in mind when it comes to partnerships: Improving customer experience and engagement. And this can be enabled through data in which its potential is magnified through digital partnerships.

Some trends and consumer behaviors explicated by RGA are as follow:

The bancassurance market can be segmented by age, income and needs. The four main segments are illustrated in the table below:

| Market Segment | Who are they? | What do they need? |

| Mass market | Generally made up of younger individuals, usually embarking on their adult lives. | Need simple savings products and insurance protection. |

| Mass affluent | Generally consists of a somewhat older population who have already amassed property, savings and offspring. | Have similar (but more defined and costly) needs than the mass market, and focus more on post-retirement needs. |

| High-net-worth (HNW) | A cohort of individuals whose main lifecycle expenditures have generally concluded. | Needs are more likely to be lifestyle protection, legacy planning, estate conservation and taxation planning. |

| Businesses | Consisting of owners of small and medium-sized enterprises (SMEs) and corporations. | SME owners and their key employees have enhanced personal and business protection needs. In addition, the worksite market, a mass market with rising protection needs and a great deal of development potential, is emerging as a powerful opportunity available within this channel. |

Source: Asia’s banks and insurers seek innovation in partnerships, October 2012, RGA

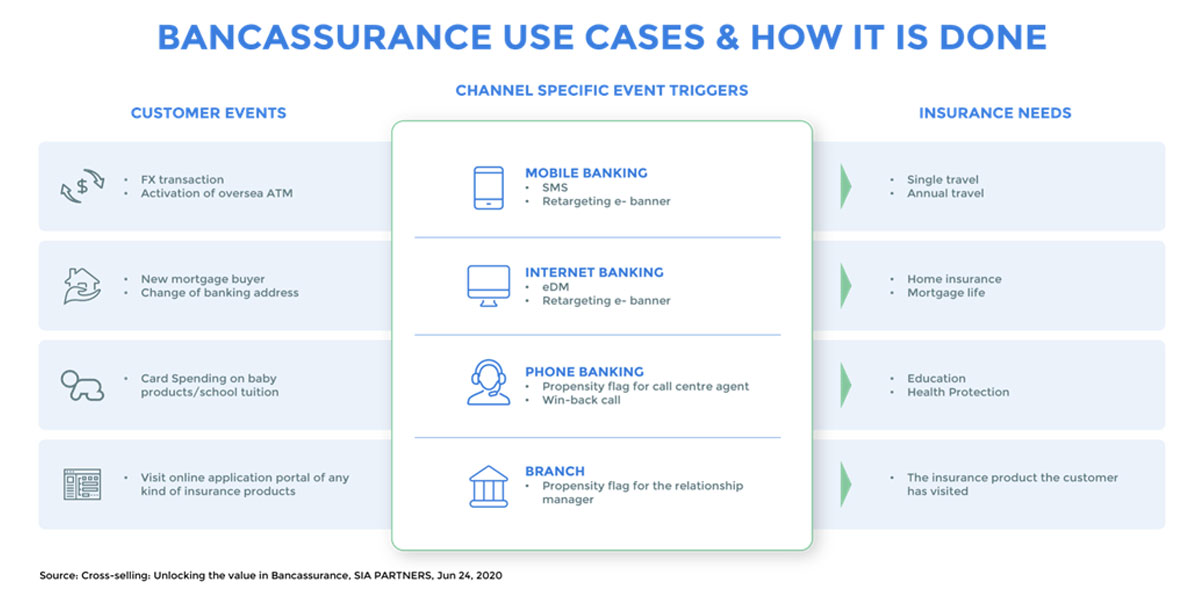

Source: Cross-selling: Unlocking the value in Bancassurance, SIAPARTNERS, Jun 24, 2020

As illustrated above, the first column explicates some examples of event triggers specific to the customer’s banking journey. Second column illustrates the different means and channels that can be optimized to address the event triggers, and finally the third column reflects the role of insurance in addressing other complementary needs along this journey to build on to your value proposition.

Partnerships with insurers not only allow banks to generate new revenue streams but also inspire innovation by improving the customer experience to a digitally-enabled one through simple yet fully automated, end-to-end processes. To decrease banks’ reliance on paper and reduce manual underwriting, real-time quoting and contracting should be implemented. For example, a bank in Eastern Europe streamlined every stage of the process–from engaging customers to closing contracts–keeping the customer at the core of the innovation. This was done by reducing the amount of data required by pre-populating it from the bank or insurer and standardisation of the user experience across channels be it online or through call centres by using one common platform.

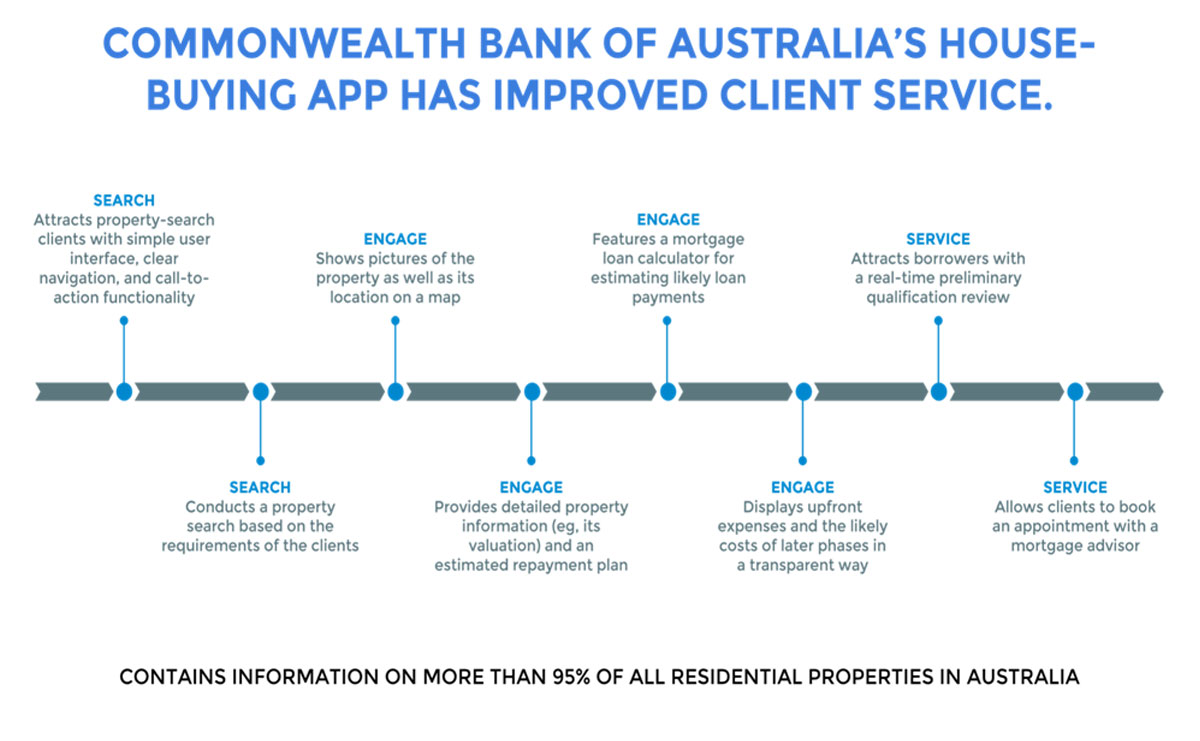

Another example would be how the Commonwealth Bank of Australia employed a house-buying app with a highly efficient and attracting customer journey. These insights on catering to the customer’s requirements, engaging the user through various services and offering assistance in the home-buying process, enlisted in the diagram below, can also be applied to insurance. Infact, the app is a great opportunity to create an insurance ecosystem by embedding the product within the research and sales process.

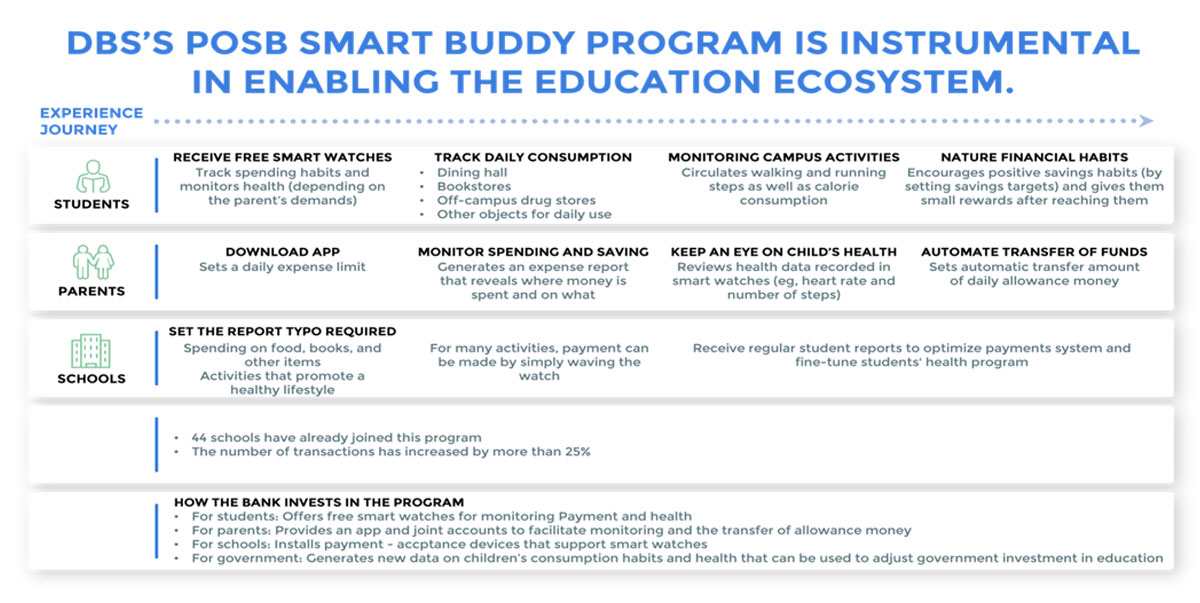

Banks offer numerous possibilities for the benefit of insurers and have vast untapped potential for partnerships. For instance, as per the diagram below, DBS’ POSB Smart Buddy program collects real-time information on students’ and parents’ spending habits and health through smart-watches, a gold-mine of data for insurers. This data can be used to improve automatic underwriting and create uniquely personalised and flexible insurance products for these customers thus enabling insurers to keep up with real-world trends.

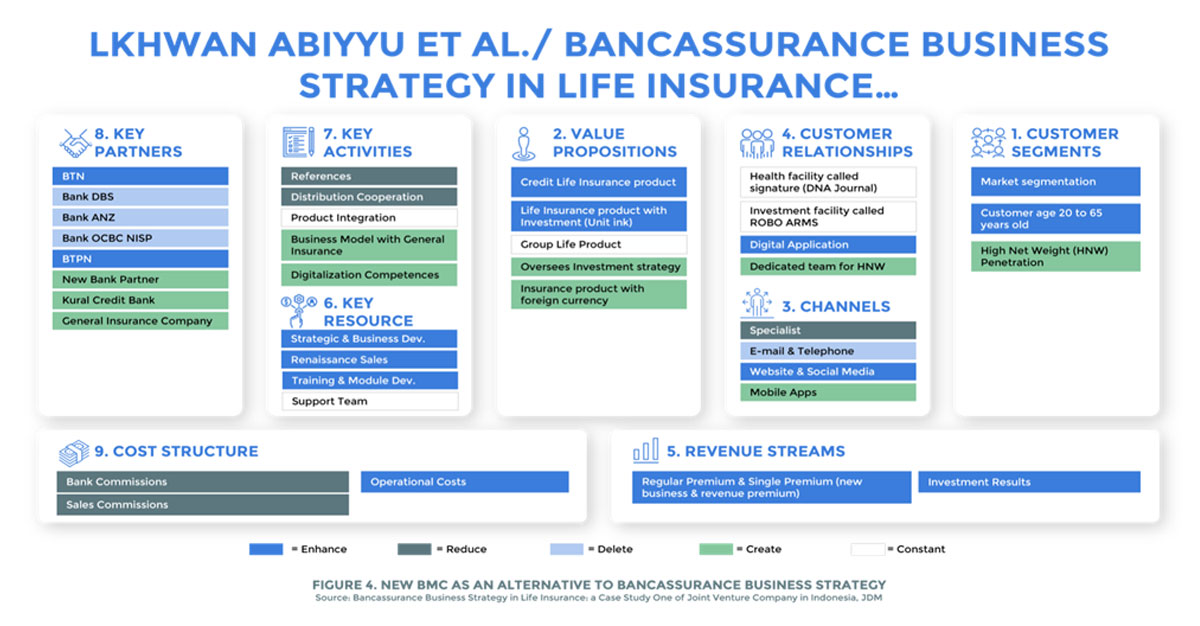

Below is the model of a bancassurance company assessed on several parameters. These parameters ensure a bank or insurer’s alignment to enter a partnership and what they bring to the table while entering one.

Source: Bancassurance Business Strategy in Life Insurance: a Case Study One of Joint Venture Company in Indonesia, 2020, JDM

Within bancassurance partnerships, insurers tend to play one or more of these roles:

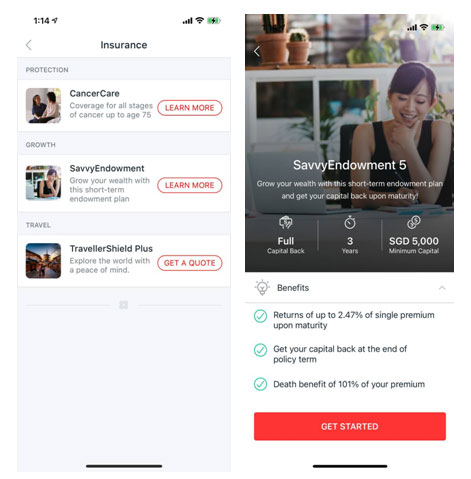

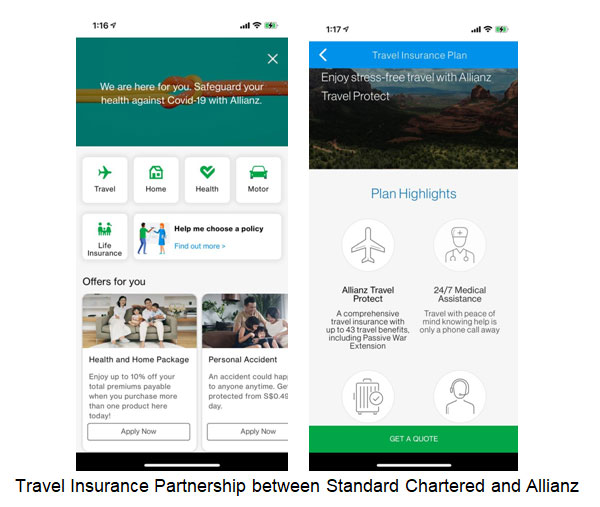

Some examples of bancassurance partnerships in Asia include:

| Region | Bank | Insurer | Product Line | Insurance Products Involved |

| Singapore, Hong Kong, China, Indonesia, Taiwan | DBS Bank | Chubb Limited | Life insurance, General insurance | – TravellerShield Plus (travel insurance)

– Home, contents and selected personal accident and supplemental health (A&H) insurance products – General insurance products for SMEs |

| Hong Kong, Singapore, China and Indonesia | DBS Bank | Manulife Financial Asia Limited | Life insurance | – SavvyEndowment (short-term endowment plan)

– CancerCare (medical insurance) |

| Hong Kong, Singapore, Malaysia, Indonesia and China | Standard Chartered Bank | Allianz | Life insurance, General insurance | – Life & Health Insurance

– Travel, personal accident, fire and motor insurance products (Allianz Home Protect, Travel Protect, Motor Protect) |

| Hong Kong and Mainland China | BEA (Bank of East Asia) | AIA | Life insurance, General insurance | – Life & Critical Illness protection (eg. Expert Term Life Plan, Wisdom Term Life Plan)

– Retirement & Savings (eg. AIA Deferred Annuity Plan) |

| Indonesia | BRI | FWD | Life insurance | – Life insurance products |

| Singapore, Indonesia, Malaysia, Thailand and Vietnam | UOB | Prudential | Life insurance, General Insurance | – Simple Insure

– Savings plans (PRUActive Saver, PRUActive Wealth) – Legacy Plans (PRULife Vantage Achiever Prime) |

| Indonesia | Maybank | Allianz | Life insurance, General Insurance | – MyProtection Bijak (Shariah-compliant unit-linked life insurance product)

– MyProtection Prima (Combines protection and investment in one easy solution) – MyProtection Investa (Single-premium investment product) |

| Singapore | Maybank | Etiqa | Life insurance, General insurance | – Life Insurance (Esteem Legacy, Esteem Eternity)

– Travel (eProtect Travel) – Maid |

| Singapore | Maybank | Chubb | General insurance | – Accident Cover (EverEase, EverSound, EverPrime)

– Home & Car (EverHomecare Enhanced, EProtect Home Pro) |

| Thailand | Bangkok Bank | AIA | Life insurance | – Retirement (Be Together SmartRetirement),

– Investment, Savings (Be Together Save+), – Family, Health, etc |

| Thailand | Krung Thai Bank | AXA | Life insurance | – Savings (iInvest, Life Legacy)

– Life (Life Ensure 10, Life Ensure 18) – Unit-Linked (iWealthy, iLink) – Retirement and Health |

| Vietnam | VietinBank | Manulife | Life insurance, General insurance | – Insurance, wealth and retirement products |

| Vietnam | MSB | Prudential Vietnam | Life insurance, General insurance | – Life and retirement products |

| India | RBL Bank | ICICI Prudential Life Insurance | General insurance

|

– Protection and long-term savings products |

| 11 markets (Hong Kong, Singapore, Thailand, China, Indonesia, Philippines, Vietnam, Malaysia, Australia, India and Korea) | Citibank | AIA | Life insurance | – Life insurance products (AIA Prime Secure, AIA Guaranteed Protect Plus)

– Retirement, Wealth & Savings Plans |

| Philippines | EastWest Bank | Aegeas | Life insurance | – Life insurance products |

| Vietnam | HDBank | Dai-ichi Life Vietnam | Life insurance, General insurance | – Life and retirement products |

| Malaysia | RHB Capital | Tokio Marine Life Insurance Malaysia | Life insurance | – Conventional life insurance products (eg. lifetime Guaranteed Cash Payment upto 100 years) |

| 11 markets (Hong Kong, Singapore, Indonesia, Thailand, Malaysia, the Philippines, Vietnam, India, Taiwan, China and South Korea) | Standard Chartered | Prudential | Life insurance | – Life insurance products |

The trend of consolidation in financial services has made bancassurance partnerships more important. Integration and overlap in terms of ambitions and synergies increases profitability and lowers costs due to shared technology, shared marketing and so on. Since banks have a large consumer base and numerous touchpoints, these partnerships are key distribution channels for insurers. For instance, Singapore’s DBS Bank and the insurer Chubb partnered in 2017 and since then have launched more than 20 business insurance and 15 consumer products. Chubb’s travel insurance is distributed across DBS Bank’s various platforms, such as Paylah!, a mobile wallet. One example of efficient deployment of technology for instant claims payment for travel insurance is DBS IDEAL RAPID, an application where corporates can plug in to pay their customers easily. This has reduced claims processing time from a week to just a few minutes.

Individual markets have also adopted bancassurance differently with some not-as-mature markets taking up the trend favourably. In Vietnam, for instance, bancassurance has boomed since deregulation in 2005. Local banks such as VietinBank and HDBank have expanded their businesses by partnering with global and local insurers like Manulife and Dai-ichi Life Vietnam. Data from 2015 from Vietnam’s Insurance Supervisory Authority shows that insurance sales via bancassurance accounted for 3.3% of total insurance revenue.

Aforementioned that life insurance products still dominate the bancassurance market share, there is increasingly a combination of products or bundling of life insurance with general insurance products.

Instead of operating in silos, this again goes back to fixing the puzzle pieces for the customer to provide them a more holistic and comprehensive product and service offering.

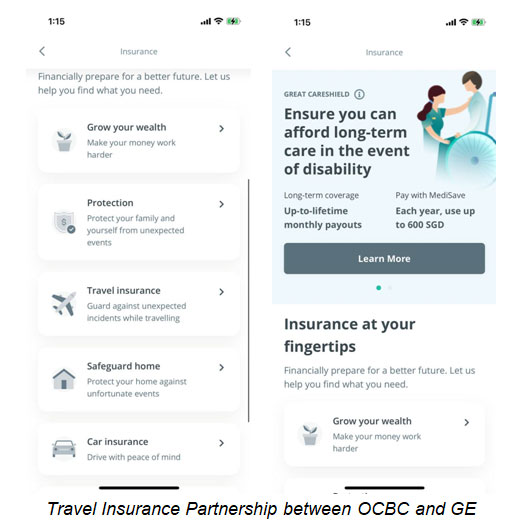

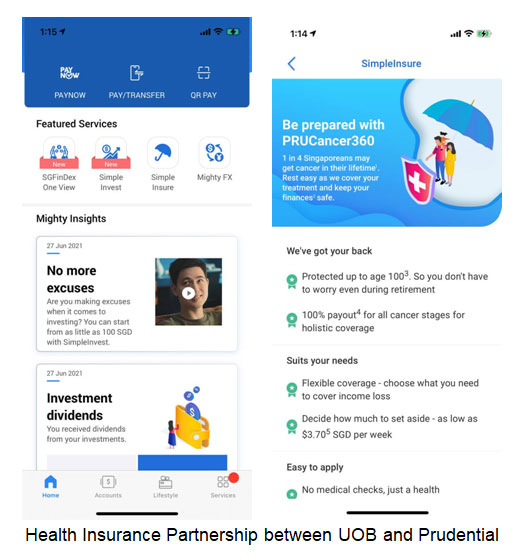

Below examples illustrate insurance products that are offered across different local banking mobile apps in Singapore.

You can see a range of partnerships across health and property and casualty (P&C) product offerings. Health insurance being insurance that covers the whole or a part of the risk of a person incurring medical expenses. P&C insurance being types of insurance that protect stuff you own (like your home and car) and offer liability coverage.

Health Insurance, Life Insurance and Travel Insurance Partnership between DBS and Chubb

Traditionally, insurance products were sold via agents and brokers.

The advent of the internet has seen the gradual rise of every type of product being sold on online platforms, and this is accompanied with the increasing comfort that consumers have buying over the world wide web. As consumers are better-informed today, they want to also be able to compare the cost of coverage from one to another. This has made it possible for us now to buy an insurance policy directly online without any intermediary involved.

Now, what’s in it for banks? As we find it necessary to reiterate, it’s with no doubt that competition breeds efficiency which is reflected in a more holistic product offering and better customer service. That being said, local and regional banks are constantly vying to hone an even better customer value proposition. Forget about that one-time loan offering and broaden your focus to the customer’s entire purchase journey.

With the vast pool of data the bank has coupled with digital analytics in place (See: CXO perspectives: A conversation on the future of bancassurance), we will see more customized products and services designed for bank customers. You want to be able to retain your customer beyond that loan period and cross-sell whenever possible to meet their newly-arising needs.

(Still wrecking your brains out on next steps for partnership? See: Top 10 Issues to Consider in a Regional Bancassurance Deal, Baker McKenzie’s Resource Hub)

Source: Bancassurance Market by Product and Geography – Forecast and Analysis 2021-2025, Technavio 2021

The trickiest issue to deal with in this partnership goes back to the exchange of data between banks and insurers regarding customer data ownership, data privacy restrictions and the lack of customer data consent procedures. And this is where insurers can take lessons from their bank counterparts in what’s called “open banking.” Open banking is the practice of opening up access to customers’ financial data to third parties in a secure manner and this is enabled by a kind of technology called application programming interfaces (APIs) (See Video: What is an API?).

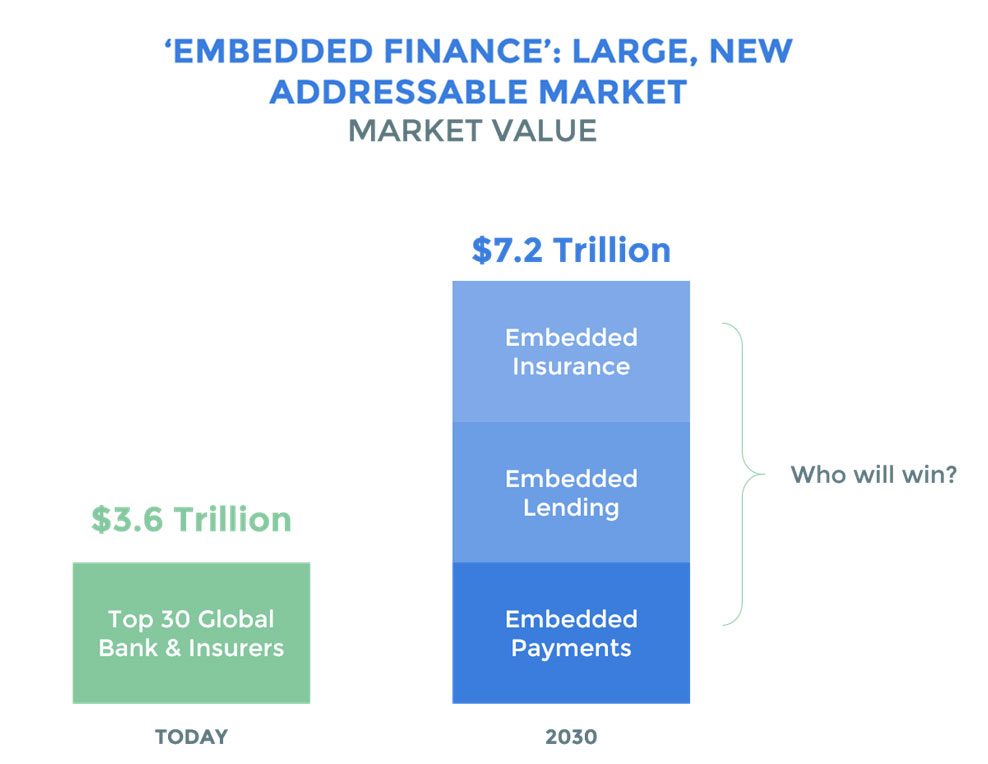

Alongside the use of advanced analytics on rich customer insights gathered by best of both juggernauts in the industry combined, the customer gets relevant offerings that are tailored to his/her unique financial needs. Think about it: There’s only so many customers you can attract on your digital channels when you work in a silo. But, when you integrate and embed yourself in other people’s applications and customer experiences, your customer outreach has no boundaries.

Today’s market size for the top global banks and insurers vs. market size for embedded finance market in 2030 (Source: Embedded finance: a game-changing opportunity for incumbents by Simon Torrance)

Also, make it hassle-free for your partners to get onboard! This embedding function enabled by API makes it easier and faster for non-insurers such as other fintech players and marketplaces to offer insurance products directly to their customers on their platforms. It also does not discriminate – whether you’re an institutionalized insurer or a tech-focused one, embedded insurance levels out the playing field for you to reach out to potential customers on other platforms.

Some trends highlighting the future of bancassurance are as follow:-

Some say that insurers have little interest to partner with neobanks which may not have the sheer infrastructure, client base and outreach compared to its institutional counterparts.

While these partnerships remain at a very early stage, there is immense potential to embed insurance products and services within neobanking platforms as they tend to position their USP in its ability to diversify the product range it offers – Beyond savings, some have expanded to spend management and credit services.

To-date, bancassurance in the neobanking space is limited to neobanks having their customers’ deposits insured by an institutional insurer or more commonly the case, neobanks launching their own insurance products by partnering with other insurtech start-ups (See: N26-Simplesurance partnership and Revolut-Qover partnership).

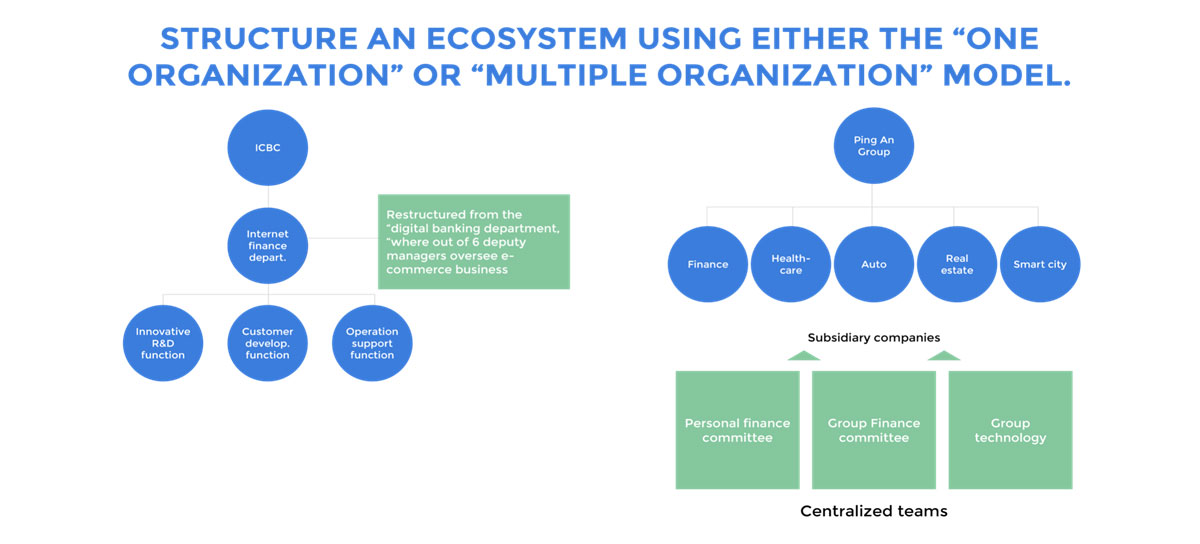

To ready themselves to partner with an insurer, banks have many different options to structure themselves in to maximise benefits reaped from the partnership. One way, as illustrated by ICBC Bank, is to set up one organisation which has many internal support functions. ICBC launched an ‘internet finance department’ to oversee smart banking, internet partnerships, customer development and so on.

On the other hand, Ping An has an ecosystem type model with multiple organisations under one group. These subsidiaries are finance, healthcare, auto, real estate and smart city, each with their own sub-subsidiaries. For example, Ping An Healthcare includes manufacturer, distributor or pharmacy, hospitals, insurance, clinics and finally the consumers. Thus, they are perfectly positioned to engage in partnerships at any level and create an efficient and growth-oriented ecosystem with the consumer at the centre.

At the heart of these partnerships is the customer – improving their user experience on the banking app. We go back to the analogy of having the customer address all of his financial needs under one roof. Similarly on a neobanking front, the customer accesses his bank account and insurance policy (as well as report, track and monitor their claims) all on one app at the comfort of their smartphone.

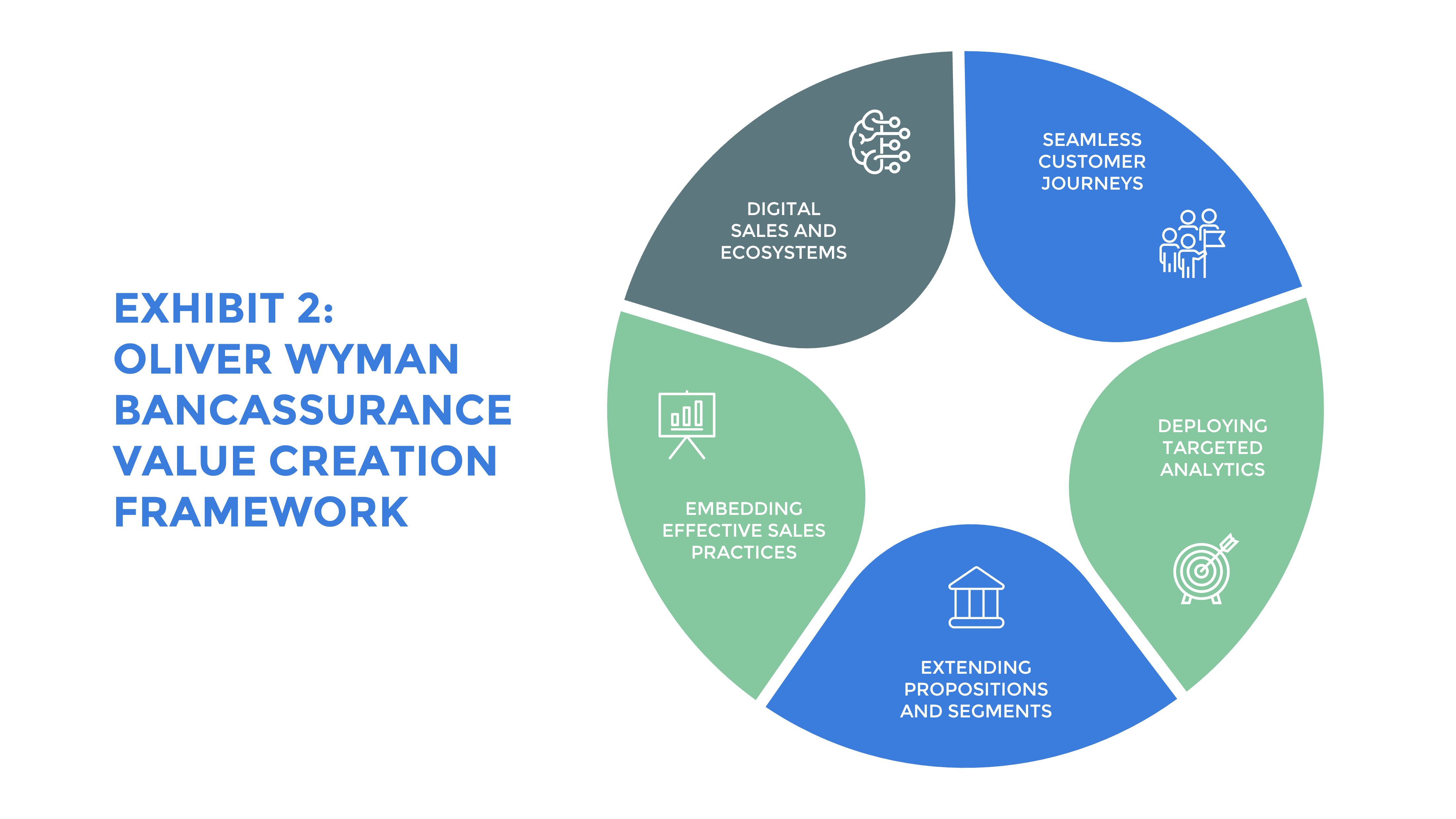

Before you go, we want to put forward the 4 pillars that successful bancassurance partnerships are built upon:

Often the differences between leaders and laggards become evident as partnerships mature and priorities reveal themselves. There are six major factors to ensure alignment of partners.

Source: Six Ways To Accelerate Value Creation, Oliver Wyman, 2020

There is vast potential for growth in bancassurance in Asia if banks and insurers continue to accelerate value creation through partnerships keeping the customer at the core of all efforts.