UAE makes itself an interesting market to cover, with some anomalistic findings contrary to its Asian and European markets.

First of all, unlike all the other markets where most travelers prefer to get their travel insurance from insurers themselves, only 15% of those surveyed would prefer insurers direct channel. On the other hand, airlines from the UAE enjoy a higher consumer trust and brand loyalty in this regard.

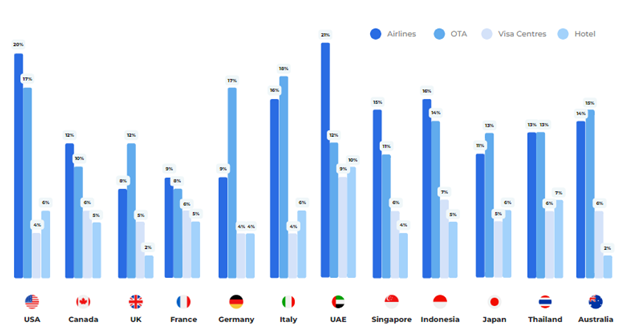

Global travelers openness to buying travel insurance from travel players

How do airlines do it? Etihad Airways, for example, provides wellness program support and flexible booking changes to increase consumers’ travel confidence to fly and purchase travel insurance from them. Recognising that COVID-19 benefits rank high on consumers’ minds, aside from enabling travelers to opt-in on the travel insurance option, they have their COVID hub on the website to provide guests with as much up to date information as possible.

Coming in top with most global travelers planning to travel in 2022 (95% of those surveyed), Etihad Airways posits that international routes see a higher interest and conversion rates for travel insurance compared to regional routes. Global comparison-wise, Emirian travelers are more divided than other markets when it comes to their intention to purchase travel insurance for regional and international trips (only 55% are intending to purchase insurance for regional and international trips).

Much is said by now, let us go into the specifics on the outlook for travel insurance in UAE and where the region is currently at when it comes to embedded insurance.

There is an almost equal split of travelers with insurance brand loyalty and there are preferred brands that stood out. For the first half of those who have a brand preference, you can find the preferred brands below:

For the other half, reasons for the lack of preference for brands include price, comprehensive coverage, personalization to needs, ease of claim service and also word of mouth. Ease of online claim service holds significant importance for Gen X aged between 41-55. Talking about COVID-19, boomers aged between 56-69 and health-focused travelers value highly the insurer’s international support capability.

What aspects of travel insurance appeal to different consumer profiles?

You can find that the additional travel insurance services most valued by travelers also center around the impact of COVID-19 on travel:

Now the current potential and growth of embedded insurance in the UAE in the coming years are evident and consistent across multiple sources.

ResearchAndMarkets.com estimated UAE’s Embedded Finance industry to grow by 43.8% on an annual basis to reach US$2,148.4 million in 2022, recording a CAGR of 25.3% during 2022-2029 and reaching up to US$7,257.7 million by 2029.

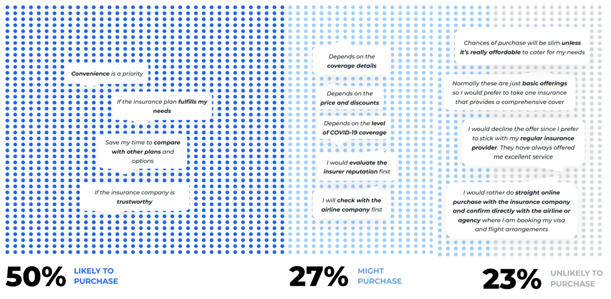

UAE is also the third largest market in our research to have the highest number of global travelers who are very likely to purchase travel insurance via embedded/in-path means, with price and convenience still leading as draw factors as with other markets.

What else would push them to opt-in include having more offerings at the point-of-purchase. Across all income levels, travelers are influenced by price discounts on travel insurance plans. Baby boomers aged 56-69 are slightly more conservative and would still opt for a preferred insurance company, while adventurous travelers are incentivized by plans that come with extra perks.

All in all, Emirian travelers are receptive to purchase travel insurance from travel players and via in-path/embedded means. By looking at the factors inhibiting potential consumers from opting-in travel insurance purchase, UAE has not yet reached the status of a market that is too mature to grow anymore. Insurers and travel players alike should explore in greater depth the aforementioned factors and opportunities for other product offerings via embedded means.