With so many travel insurance providers offering seemingly similar products nowadays, it has become a challenge to cut through the noise and stand out from the crowd. To truly stand out, travel insurers need to delve deeper, understanding their customers beyond just basic demographics.

Traditional marketing tactics often rely on demographics and conscious preferences, but what about the subconscious factors that pull the trigger on a purchase decision? This is where neuromarketing steps in, offering powerful ways to unlock the secrets of consumer behavior in the travel insurance space.

So, how can you leverage neuromarketing to supercharge your travel insurance sales? Let’s find out in this article.

Also known as consumer neuroscience, neuromarketing is a field that combines neuroscience, psychology, and marketing to understand and potentially manipulate consumer behavior and decision making. Compared to traditional marketing that relies heavily on surveys and focus groups, neuromarketing takes a different approach. It leverages tools like eye-tracking, electroencephalogram (EEG), facial coding, functional magnetic resonance imaging (FMRI), and other tools to study the decision-making process of customers.

In the travel insurance industry, neuromarketing offers valuable insights into consumer behavior. It helps insurers understand the subconscious factors that influence purchase decisions, allowing them to develop targeted messaging that addresses common concerns (like risk aversion) and craft marketing campaigns that resonate on a deeper level.

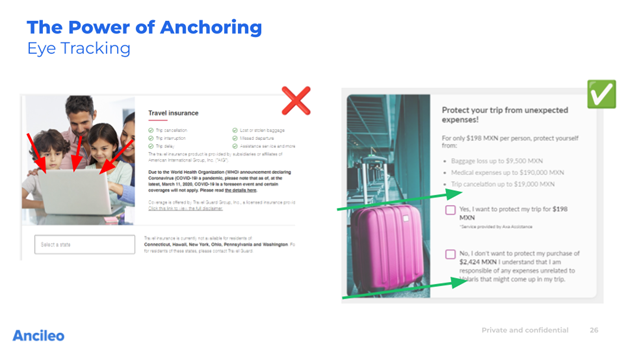

For instance, by analyzing eye-tracking data, we can understand how travelers navigate travel insurance information on a website. Similarly, studying emotional responses to visuals depicting travel disruptions (lost luggage, medical emergencies) can shed light on risk aversion and the desire for security.

At the Ancileo 2024 Travel Insurance Workshop from 26-27 February 2024, Olivier Michel, CEO & Founder of Ancileo, provided key insights into the world of neuromarketing and its implications for the travel insurance industry.

Now, let’s delve into these seven neuromarketing best practices for travel insurance:

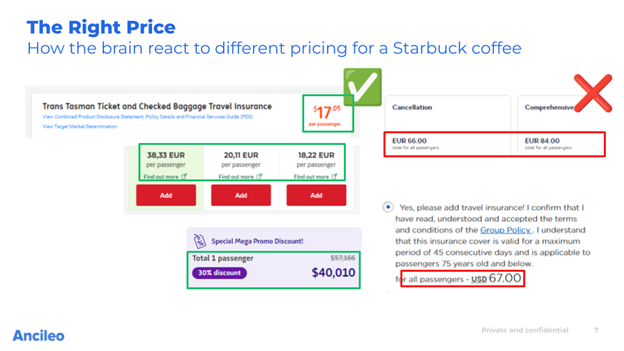

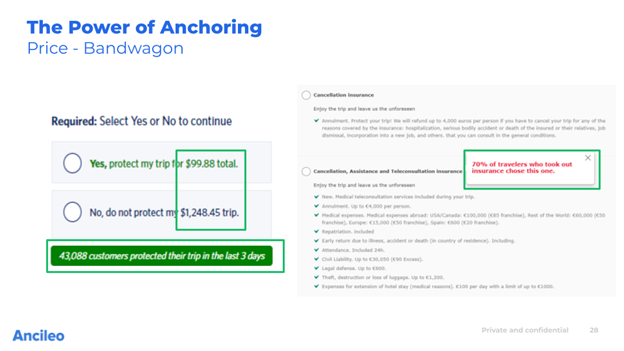

Psychological pricing is a powerful tool that goes beyond simply competing on price. It involves setting the price at a point that feels right for the customer, rather than just being competitive. For example, displaying different price points for various travel insurance plans and highlighting the benefits of each plan at its respective price point can help customers perceive the value they are receiving, leading to a more favorable decision-making process.

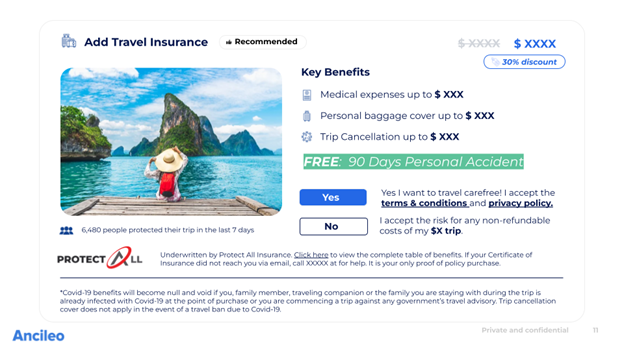

Offering something for free on top of the core travel insurance product can be a powerful attention-grabber. This could be in the form of complimentary services or add-ons that enhance the value proposition of the insurance plan. The perception of receiving something for free can significantly influence purchasing decisions, making customers more likely to choose a particular travel insurance plan over others.

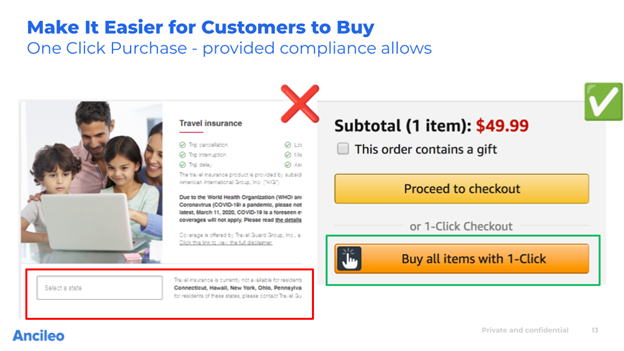

A hassle-free and straightforward purchase experience is essential for converting customer interest into sales. This involves simplifying the purchase process and minimizing the number of steps required to complete a transaction. By providing a seamless experience, travel insurers can reduce friction and encourage more customers to purchase their travel insurance products.

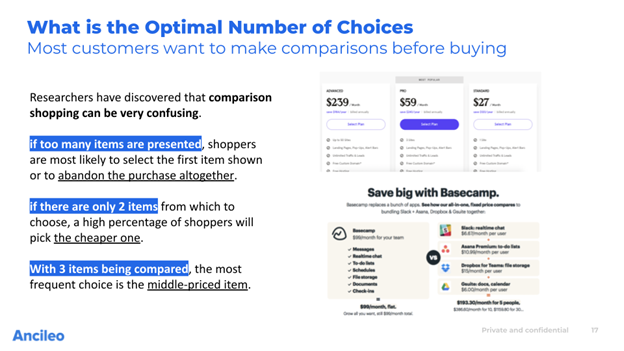

Offering customers a limited number of travel insurance options is crucial, as researchers have found that comparison shopping can be overwhelming. When presented with too many items to choose from, shoppers are more likely to either select the first item shown or abandon the purchase altogether due to decision paralysis.

When only two items are presented for comparison, a high percentage of shoppers tend to choose the cheaper option. However, when three items are compared, the most frequent choice is the middle-priced item. This highlights the importance of offering a concise selection of options to help customers make a decision without feeling overwhelmed. Clearly communicating the benefits of each option can further aid customers in choosing the travel insurance plan that best suits their needs.

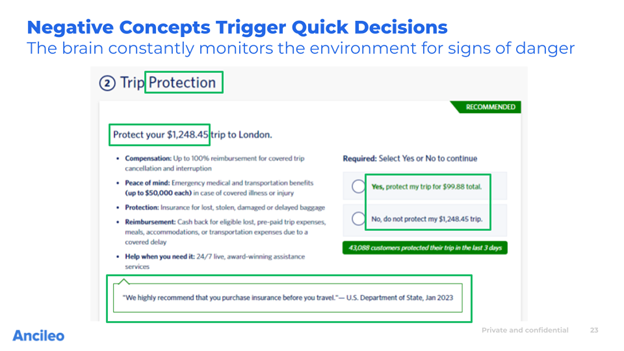

Understanding the psychological impact of highlighting risks and solutions is crucial in marketing travel insurance. Research has also shown that the avoidance of danger has the highest priority for individuals and can provoke immediate, decisive action. When people are presented with images or words that evoke danger or risk, they react strongly and immediately.

Words like “protect,” “avoid,” “danger,” and “lose” are particularly effective in capturing attention and increasing memory retention. Such negative concepts can trigger an instinctive response in individuals, prompting them to seek solutions and take action to avoid potential risks.

By highlighting potential risks associated with travel and emphasizing how travel insurance offers protection and peace of mind, insurers can prompt quick decision-making from customers. This approach not only captures attention but also positions travel insurance as a practical solution to mitigate risks and ensure a safe travel experience.

Websites designed based on eye-movement patterns tend to have longer visitor stay times. However, many template-based, generic web designs fail to capitalize on these insights into where visitors’ attention is directed. By optimizing website design to align with natural eye movement, travel insurers can effectively capture and retain visitor attention, increasing the likelihood of conversion.

Apart from leveraging eye-movement patterns, travel insures can also utilize two key principles to their advantage:

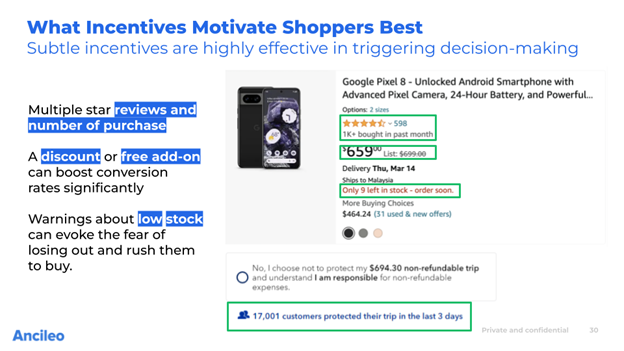

Subtle incentives play a crucial role in triggering decision-making processes. For instance, showcasing multiple star reviews and the number of purchases can create a sense of popularity and trustworthiness, influencing potential customers to make a purchase. Additionally, offering a discount or a free add-on can significantly boost conversion rates, as customers perceive added value in the deal.

The field of neuromarketing offers travel insurers a powerful toolkit to enhance their marketing strategies and drive sales. By understanding the subconscious factors that influence customer decision-making, travel insurers can tailor their approaches to resonate more effectively with their audience.

The seven neuromarketing best practices discussed in this article provide actionable insights for travel insurers looking to elevate their marketing efforts. From pricing strategies that appeal to psychological cues to leveraging the power of social proof and incentives, these practices can help insurers differentiate their offerings and create compelling value propositions for customers.

As the travel insurance industry continues to evolve, embracing neuromarketing principles can be a key differentiator in a competitive market. Through these strategies, travel insurers can not only attract more customers but also build lasting relationships based on trust and value.