The article provides a guide to introducing what parametric insurance is, where parametric applies in both B2B and B2C insurance, examples of how parametric is being embedded in the product and partnerships, as well as its relevance in the future of the industry.

Traditional insurance, as we are familiar with, pays out based on the actual cost of losses incurred. Where losses are unmeasurable or not covered in the usual range of risks put forward by insurers, parametric insurance comes in to bridge the gap.

Parametric insurance pays out when a predefined loss event occurs and the loss event reaches or exceeds the parameter or the index threshold that was pre-agreed to in the policy. Say business interruption resulting in a drop in customer numbers, instead of actual property damage caused by a natural disaster.

Fundamental Concepts of Parametric Insurance

(Source: 10 myths about parametric insurance, Swiss Re, Aug 2018)

Instead of actual damage that has occured, the indicator that determines the payout is known as the “trigger.” Triggers can range from natural disasters and weather events, which remain as the most prominent triggers, to market indices, crop yields, power outages and more. Examples of possible triggers and its relevant indexes include:

| Trigger | Index |

| Hurricane | Wind speed |

| Earthquake | Shake intensity |

| Pandemic | No. of infections |

| Cyber | Reported data breaches |

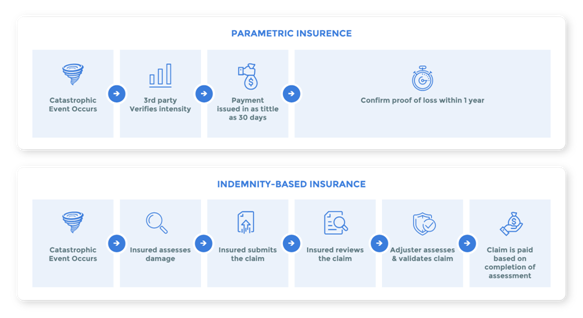

The insurance claim process can be a laborious experience for customers as they navigate through reams of jargon-filled terms and conditions indicating what’s claimable and what’s not.

For a claim to go through, the customer usually has to justify the damages incurred.

Source: How Parametric Products Benefit Catastrophe-Driven Risk Transfer, Mar 2020, Amwins

That said, the most evident benefit of parametric insurance is that it replaces traditional policy terms with simple conditions based on undisputable events. Once a certain threshold for the specified indicator has been reached or exceeded, the policyholder qualifies for the claim.

Forget endless form-filling and legal disputes if the claims didn’t go through. Compensation is immediate and automatic, and information is provided to the customer in the clearest and simplest way. Plus, the advent and rocketing growth of data analytics will provide for the increasingly novel opportunities for measurable parameters covering the remaining gaps or risks.

Whether it’s an MNC, a mom-and-pop store or a SME, natural catastrophes don’t discriminate in their damage. Every type of business needs some form of protection from the risks of inevitable events.

According to WIR 2019, 35% of business customers are highly interested in parametric insurance, versus 16% of individual customers. The most prominent types of parametric insurance for businesses are established in agribusiness and catastrophe reinsurance where triggers are relatively easy to define. For B2C consumers, parametric insurance comes in the form of travel insurance and other types of personal protection.

Across both businesses and individual consumers, the demand for parametric insurance will undoubtedly become a more mainstream means to build resilience and strengthen recovery as the range of unpredictable events – whether they’re climate-related, disease outbreaks or cyber attacks – may become more severe moving forward.

| Insurer | B2B or B2C? | Type of Insurance |

| AIR Worldwide (Owned by Verisk) | B2B | Natural catastrophes |

| RMS | B2B | Natural catastrophes |

| New Paradigm Underwriters | B2B | Hurricane insurance |

| FloodFlash | B2C | Flood protection |

| Global Parametrics | B2B and B2C | Natural catastrophes |

| Descartes Underwriting | B2B | Natural catastrophes |

| Jumpstart Recovery | B2C | Earthquake insurance |

| Exante | B2C | Hurricane insurance |

| African Risk Capacity | B2C | Natural catastrophes |

| Blink | B2C | Flight cancellation insurance, and domestic appliance insurance |

| Arbol | B2B | Crop protection |

| Qomplx | B2B | Cyber and terrorism cover for SMEs |

Parametric policies may be offered in two forms: (1) As a microinsurance product; or (2) As an add-on to an existing (insurance) product. In both of these forms, they are usually sold directly to the consumer via mobile technologies.

As a microinsurance product, having it in the parametric form provides a solution for issues of scalability. The traditional model of agricultural insurance may work for larger-scale industrial farms in the US or Europe. Premiums are usually large enough to cover underwriting and claims management costs if something happens to these farms.

However, in rural India where majority of the agriculture is smallholder farms. This traditional model won’t work- Farmers cannot pay for a large premium and don’t have big farms to make claims for. That said, parametric policies that are packaged with microinsurance principles help to fill this protection gap among smallholder farmers.

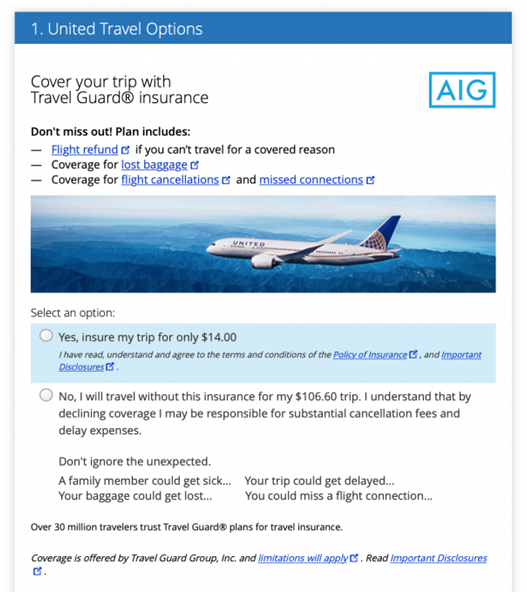

As a product add-on, the most familiar product we know of is travel insurance. It’s very common for travel insurance to be included as an add-on when you’re purchasing flight tickets. Flight cancellation and delay are some key areas in which parametric policies have been a win-win solution for both consumers and insurers.

Source: Airline Travel Insurance vs. Independent Travel Insurance: Which Is Right for You?, Oct 2019, Nerd Wallet

For the customer, the benefits are the most evident- immediate, data-triggered payments once a specific event has occurred. What about it for insurers? Aside from happy customers, insurers are able to better predict their losses and set their rates accordingly given that the parametric model is based upon objective measurements and upfront, fixed payments which eliminates as much uncertainty. Also, consider the time and cost savings when you keep claims cycles short and efficient!

And all of these benefits are made possible through data. Only through years and years of gathering claim and risk-related data that insurers are able to create such offerings. This has resulted in an influx of insurtechs dabbling in parametric space in both coming up with the technological means of delivering other insurers’ products (aka insurance distribution) as well as in developing their very own product offerings to snap a slice of the pie from incumbent insurers.

Partnership is the name of the game in the insurance ecosystem today. Some key global insurance partnerships for parametric include:

Parametric insurance will not just remain as a fad in times of COVID-19 where uncertainty is at all-time high. We’re only at the verge of this trend and yet to take flight in the skies.

One of the key trends highlighting the promising future of parametric is the rise of the blockchain which would enable smart contracts enabling automatic, immediate transactions that are independently-verified without the need for third parties to step in. This could accelerate the claims process even further while ensuring trust.

Finally, we want to highlight that parametric is reshaping the risk reality as more and more datasets are being mined to reveal previously unknown trends and patterns. That said, we’re also looking at a more accurate representation of risks which enables for a more straightforward and efficient risk transfer product.