Claims administration is pivotal in ensuring customer satisfaction and operational effectiveness in the travel insurance sector. Efficient handling of claims is crucial for the insurance provider and the policyholder. As the travel insurance industry evolves, the importance of operational efficiency and automation in claims administration becomes increasingly apparent. RPA can significantly reduce processing time and improve accuracy by automating repetitive and manual tasks.

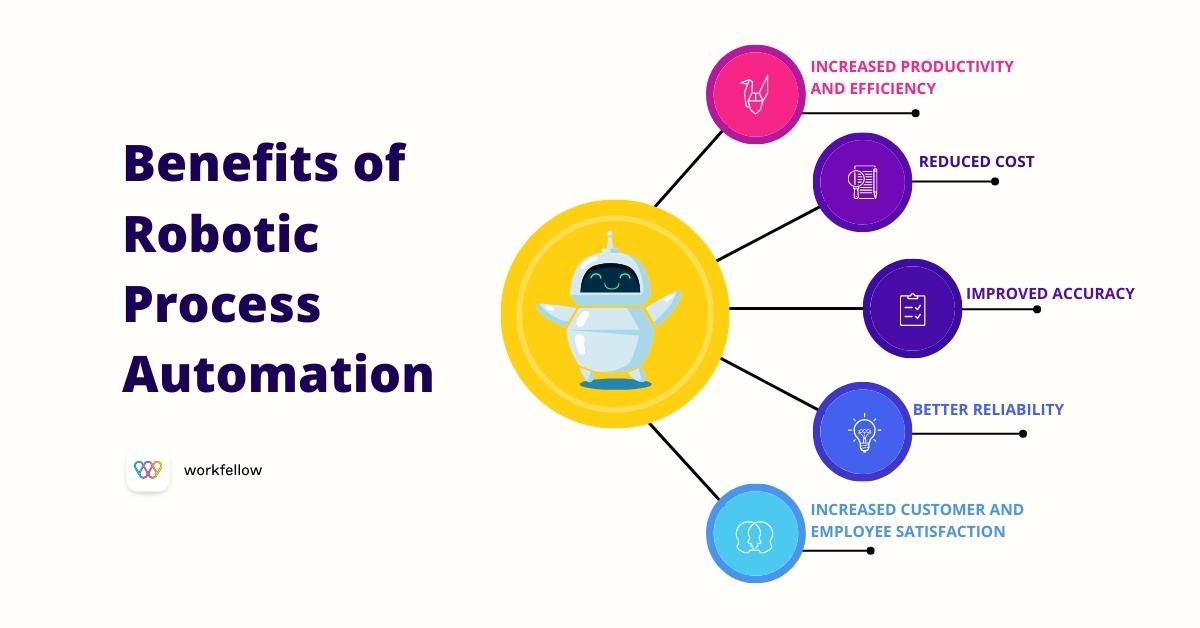

Automation can also integrate with existing systems, allowing seamless data transfer and real-time updates. This article delves into the significance of implementing Robotic Process Automation (RPA) in travel insurance claims administration. It explores how RPA can streamline processes, reduce errors, and enhance operational effectiveness. Robotic Process Automation (RPA) offers numerous benefits for travel insurance claims administration.

Robotic Process Automation (RPA) is the use of software robots or “bots” to automate repetitive, rule-based tasks within business processes. These bots are designed to interact with digital systems and applications like humans but with greater speed and accuracy. RPA operates based on mimicking human actions to complete tasks like data entry, invoice processing, and more.

In claims administration, RPA streamlines insurance claims processing by automating routine tasks such as data entry, verification, and documentation management. This allows claims to be processed more efficiently, leading to quicker resolution and improved customer satisfaction. RPA implementation has resulted in an average reduction in processing time. Further, it allows insurance companies to handle claims and manage policies more swiftly.

RPA significantly reduces the operational cost, minimizing the need for manual intervention. Thus, decreasing resource requirements and operational expenses. It has significantly decreased error rates, ensuring that insurance processes are carried out with precision and reliability. RPA also enhances compliance and regulatory adherence in insurance processes. By automating tasks and ensuring consistent adherence to rules and regulations, RPA helps insurance companies avoid penalties and maintain regulatory compliance.

RPA integration in travel insurance claims management brought various benefits. These key benefits are detailed below:

Integrating Robotic Process Automation (RPA) into claims administration allows for the seamless streamlining of claims intake and processing. RPA can automate repetitive tasks, such as data entry and document processing, leading to increased efficiency and accuracy in the claims handling process.

RPA enables automated data extraction and validation, reducing the need for manual data entry and minimizing errors. This leads to improved data accuracy and consistency, ensuring that claims are processed with the highest level of precision. By leveraging RPA, organizations can significantly reduce claim processing time. Statistics indicate a good reduction in claim processing time, allowing for quicker claims handling and faster payouts to policyholders.

The integration of Robotic Process Automation (RPA) in claims administration significantly enhances the overall customer experience. By automating various tasks, RPA ensures quick claims resolution, reducing the waiting time for policyholders. This speed and efficiency help in building trust and reliability, as customers receive timely updates and swift responses to their claims. Automated systems can also handle large volumes of claims simultaneously, which minimizes delays and errors, leading to a smoother and more efficient process.

Additionally, RPA improves transparency and communication with policyholders. Automated processes provide clear and consistent updates, keeping customers informed at every stage of their claims. This level of transparency reduces uncertainties and fosters a sense of security among policyholders. Better communication facilitated by RPA also means that customers can have their queries addressed promptly, further enhancing their overall experience. As a result, implementing RPA in claims administration streamlines operations and significantly boosts customer satisfaction and loyalty.

Robotic Process Automation (RPA) offers unparalleled scalability and flexibility in managing varying claims volumes. During peak times, such as natural disasters or seasonal surges, organizations can leverage RPA to efficiently handle increased claim loads without sacrificing the quality or speed of claims processing. This scalability ensures that policyholders receive timely responses even during high-demand periods, maintaining service levels and customer satisfaction.

In addition to scalability, RPA significantly improves compliance and auditability within claims administration. Automated processes enable organizations to meticulously track and monitor each step of the claims handling process, ensuring adherence to regulatory requirements. This level of detailed oversight helps meet compliance standards and facilitates easy and accurate auditing. With RPA, organizations can generate comprehensive reports and maintain accurate records, which is crucial for regulatory reviews and internal audits.

Source: Achieving Business Scalability with Robotics Process Automation Entrepreneurship – FasterCapital

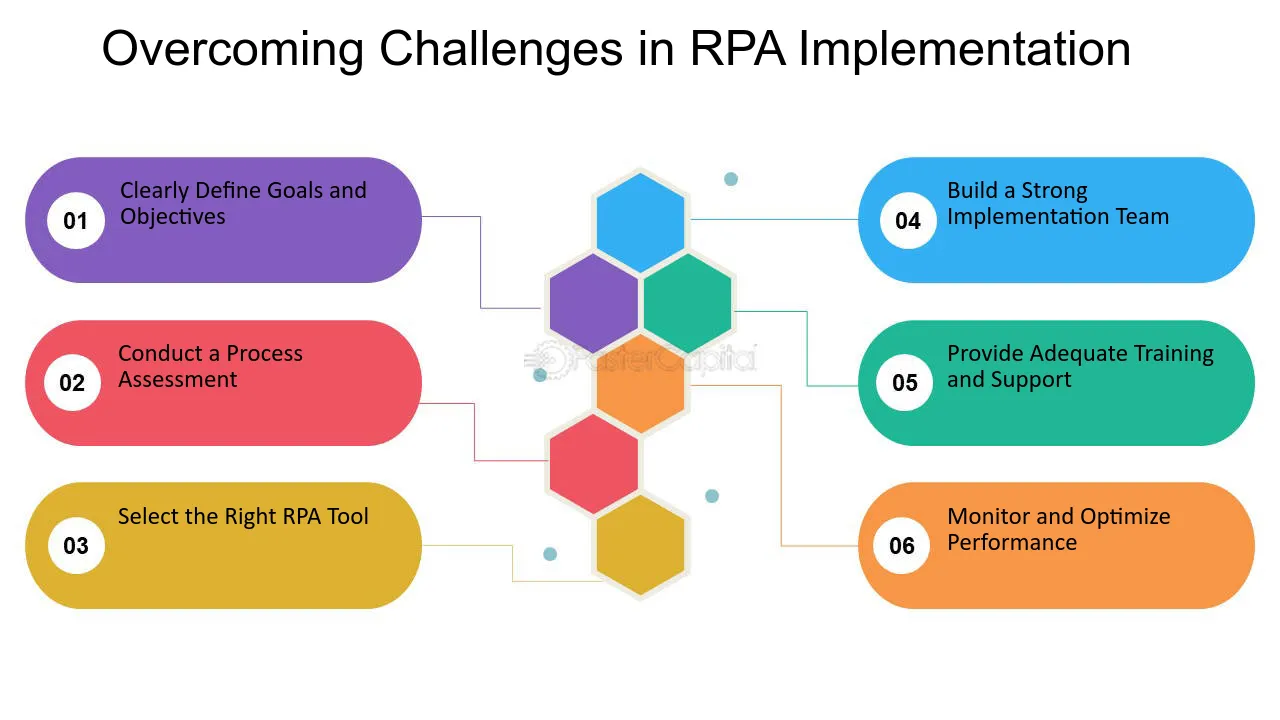

RPA implementation, along with its various benefits, also suffers various challenges. These challenges include:

Implementing Robotic Process Automation (RPA) in travel insurance comes with initial setup costs that can be a significant challenge for organizations. The cost of RPA software, infrastructure, and training can be substantial. Thus, organizations need to carefully weigh these costs against the expected return on investment (ROI). According to statistics, organizations implementing RPA in travel insurance have seen an average ROI. However, this varies based on the scale of implementation and the processes automated.

Integrating RPA with existing systems and processes poses another challenge in the travel insurance industry. Legacy systems, disparate data sources, and complex business processes can hinder the seamless integration of RPA. Ensuring RPA works effectively with these existing systems while maintaining data integrity and process efficiency requires careful planning and execution.

Employee resistance to RPA implementation is a common challenge, particularly in the travel insurance sector, where employees may fear job displacement. Change management strategies need to be put in place to address this resistance. This includes transparent communication, upskilling and reskilling programs, and demonstrating how RPA can augment employee capabilities rather than replace them.

Compliance with industry regulations and regulatory requirements is paramount in the travel insurance sector. Implementing RPA must align with these regulations to ensure data security, privacy, and ethical use of automation. Organizations need to navigate the complex landscape of regulatory compliance and ensure that RPA implementation meets the standards set by industry regulators.

Source: Robotic Process Automation (RPA) Tools and Examples – Workfellow

The optimized workflow of RPA in travel insurance consists of the following steps:

To optimize workflow with Robotic Process Automation (RPA), the first step is to map out the current claims processes in detail. This involves identifying each step in the process, the stakeholders involved, and the time and resources required for each task. By mapping the current claims processes, organizations can understand the workflow clearly and pinpoint areas prone to bottlenecks and inefficiencies.

Once the current claims processes are mapped, the next crucial step is identifying bottlenecks and inefficiencies within the workflow. This involves analyzing data, gathering stakeholder feedback, and conducting process audits to pinpoint areas where the workflow can be optimized. Identifying these bottlenecks and inefficiencies is essential for developing a targeted RPA implementation strategy.

With a clear understanding of the current claims processes and the identified bottlenecks and inefficiencies, the next step is implementing RPA to optimize the workflow. RPA can automate repetitive and rule-based tasks, streamline data entry processes, and improve the overall efficiency of claims processing. By integrating RPA into the workflow, organizations can reduce manual errors, accelerate processing times, and enhance productivity.

Source: Cloud Automation Refining Efficiency and Reducing Manual Tasks (nakatech.com)

Claims administration typically involves manual tasks like document handling, routine data entry, and verification processes. However, with the advent of Robotic Process Automation (RPA), ample opportunities exist to automate these tasks, significantly reducing human intervention. RPA technology can streamline document handling and processing, making it more efficient and error-free.

Moreover, routine data entry and verification processes, which are traditionally time-consuming, can be automated through RPA. This further frees up valuable human resources for more complex and strategic tasks. As a result, implementing automation in claims administration enhances operational efficiency and minimizes the risk of errors associated with manual intervention.

Organizations can experience increased productivity and cost savings by automating these manual tasks. RPA technology allows faster document processing and data entry, leading to quicker claims resolution and improved customer satisfaction. Additionally, reducing manual intervention decreases the likelihood of errors, ensuring greater accuracy in claims administration. Overall, embracing automation in this field can revolutionize the efficiency and effectiveness of claims processes.

PZU, a prominent insurer based in Poland and a major European player, has successfully implemented Robotic Process Automation (RPA). This can enhance operational efficiency and customer service in various areas, including claims administration. RPA freed up PZU agents’ time to focus on more complex tasks and provide better customer service. The company’s call center wait times were cut in half, and data entry became 100% accurate while eliminating the need for overtime and other error-related costs.

Cattolica Assicurazioni, a prominent Italian insurance firm, implemented UiPath’s RPA to automate its financial reconciliation processes. Initially projected to take six months manually, RPA reduced the timeline to just two months. In contrast, achieving a zero-error rate in processing 20,000 lines of financial data. This automation improved efficiency and accuracy and allowed reallocating resources to more strategic tasks.

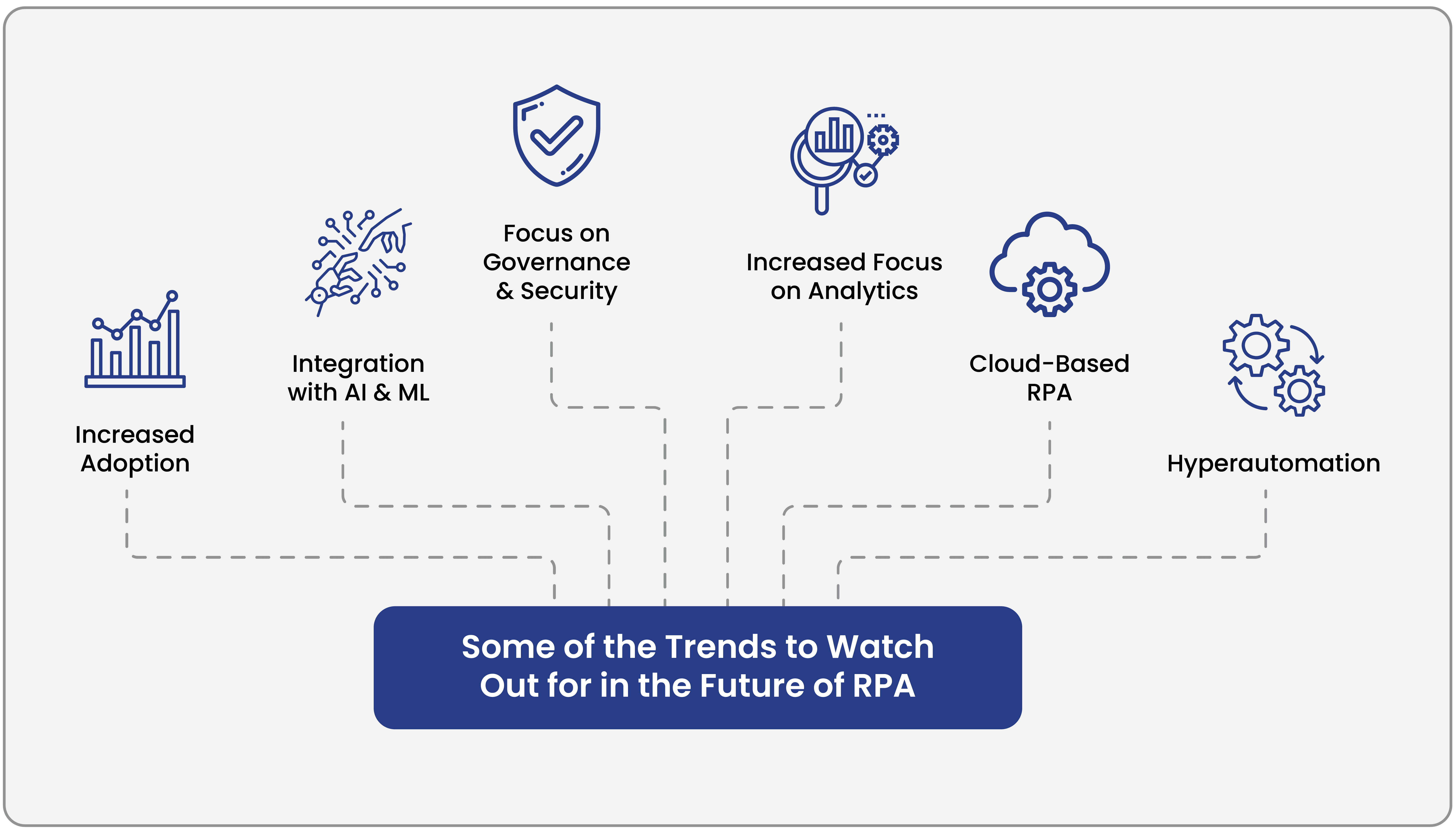

Source: The Future of RPA: Trends to Watch Out for in 2023 (sdlccorp.com)

The future of Robotic Process Automation (RPA) in travel insurance is poised to be shaped by several emerging trends. One of the key trends is the increasing integration of AI and machine learning with RPA to streamline claims administration processes. This integration enables RPA systems to analyze and process large volumes of travel insurance claims data more accurately and efficiently.

Additionally, predictive analytics powered by AI and machine learning will significantly forecast claim patterns and identify potential fraud. Further leading to improved risk management. As RPA continues to evolve, it is expected to enhance travel insurance claims processing speed, accuracy, and compliance. In addition, ultimately delivers a more seamless and customer-centric experience.

Furthermore, another trend in the future of RPA for travel insurance is the adoption of chatbots and virtual assistants. These AI-powered tools can assist customers in filing claims, answering policy-related questions, and providing real-time updates on claim status. By leveraging natural language processing and machine learning algorithms, chatbots and virtual assistants can offer personalized and efficient support to policyholders. This integration of RPA with AI technologies improves operational efficiency and enables insurers to provide timely assistance to their customers.

The benefits of Robotic Process Automation (RPA) in claims administration are clear, as it leads to streamlined processes, reduced errors, and enhanced customer service. These advantages contribute to operational efficiency and a more responsive approach to handling claims, crucial in maintaining customer trust and satisfaction. However, it is important to acknowledge the challenges associated with implementing RPA, such as the initial setup costs and potential resistance to change from staff. Addressing these challenges requires thoughtful planning, training, and a commitment to a gradual transition, ensuring that the integration of RPA is smooth and effective.

Embracing automation through RPA is vital for insurance companies aiming to achieve operational efficiency, cost savings, and better resource allocation. To remain competitive in the rapidly evolving insurance industry, companies must explore and adopt RPA solutions. This technological advancement enhances productivity and ensures superior customer experiences by providing faster and more accurate claims processing. By leveraging RPA, insurance companies can optimize their claims administration processes, adapt to industry changes, and ultimately deliver higher value to their customers, securing their position in the market.