AI in insurance claims processing is already making waves among travel insurers due to advancements and the sophistication of the technology. Traditionally, claims adjustment in travel insurance heavily relied on manual processes, often resulting in time-consuming and error-prone procedures. However, with the advent of AI and machine learning, the industry is witnessing a paradigm shift towards more efficient, accurate, and streamlined claims adjustment processes.

The integration of AI and machine learning technologies has significantly impacted the travel insurance sector, particularly in claims adjustment. These technologies have empowered insurers to automate various aspects of claims processing, including fraud detection, risk assessment, and decision-making. By examining the evolving landscape of travel insurance and the rise of these technologies, readers will gain a comprehensive understanding of the changing dynamics within the traveling industry.

In this article, we provide insights into how AI and machine learning redefine adjuster roles in the context of adjustment of travel insurance claims. Furthermore, the article aims to underscore the potential benefits of embracing AI and machine learning in claims adjustment, addressing potential challenges and considerations associated with this technological shift.

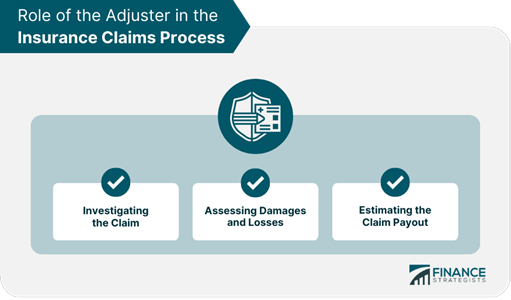

Source: Insurance Claims Process | Meaning, Roles, & Important Tips (financestrategists.com)

Traditional claims adjustment has its roots in the early travel insurance industry, where the process primarily involved manual assessment and negotiation. Over time, as the travel industry evolved, the methods for handling claims have also developed to incorporate more structured and standardized approaches.

Claims adjusters play a pivotal role in traditional claims adjustment. They evaluate the validity of claims, determine the extent of coverage, and negotiate settlements. They act as intermediaries between the travel insurance company and the claimant, aiming to reach fair and equitable resolutions.

However, it is essential to know that traditional claims adjustment methods often face challenges related to inefficiencies in manual processes, potential for human error, and delays in claim resolution. Additionally, the increasing complexity of claims, coupled with evolving regulations, poses ongoing challenges for traditional approaches.

Understanding traditional claims adjustment involves travel insurance recognizing its historical evolution, the pivotal role of claims adjusters, and the challenges inherent in conventional methods. As the travel insurance industry continues to evolve, there is increasing emphasis on leveraging technology and data-driven approaches to enhance the efficiency and accuracy of claims adjustment processes.

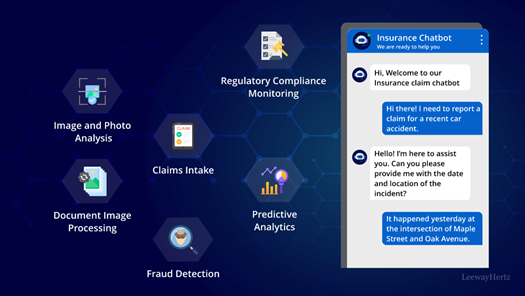

Source: AI in claims processing: An overview (leewayhertz.com)

Artificial Intelligence (AI) and machine learning technologies involve the development of algorithms and models that enable computers to perform tasks that typically require human intelligence. It includes tasks such as learning, problem-solving, and decision-making.

Using AI to automate insurance claims has several applications in insurance claims processing.

AI is utilized to automatically extract and analyze data from various sources such as claim forms, images, and documents. It streamlines the AI insurance claims processing workflow, reduces manual errors, and accelerates the assessment process in the travel insurance industry.

AI algorithms can be employed to analyze historical data and predict future claim trends, enabling travel insurers to assess risks accurately and set appropriate premiums.

AI can analyze large volumes of data to identify patterns indicative of fraudulent claims in travel insurance. It helps insurers detect and prevent fraudulent activities, ultimately reducing financial losses when using AI for insurance claims.

Lemonade Inc. is a digital travel insurance company that implements AI into its claim adjustment process. They use an AI chatbot named Jim to handle claims and satisfy customers. Jim utilizes AI and natural language processing to interact with customers. The AI application helps the company collect claim details and process payouts.

Lemonade reports that Jim has been able to process a significant portion of claims without human intervention, resulting in faster claim processing times and improved customer satisfaction. It keeps the travel insurance claiming process hassle-free and mitigates the risks of malfunctioning. By utilizing the AI power lemonade claims, they pay the fastest claim in just three seconds.

FWD has leveraged AI across various touchpoints, from automated underwriting for faster approvals to AI Claims 2.0 for instant claim decisions on low-risk cases. It not only streamlines the process for customers but also frees up resources for human adjusters to handle complex situations.

Furthermore, FWD utilizes AI to combat fraud and win back lapsed customers. Their AI Fraud Detection system identifies suspicious claims, while the AI Winback Campaign re-engages inactive policyholders. This two-pronged approach ensures a secure environment for all customers and fosters long-term relationships.

Liberty Mutual is applying AI technology to the insurance industry, though with a focus on car accidents. The company aims to leverage AI for faster damage assessment and cost estimation through smartphone apps. It could potentially reduce the workload of human adjusters and streamline the claims process.

While the document talks about investment in a venture capital firm (LMSV) focused on insurance industry innovation, there’s no mention of applying similar AI advancements to travel insurance claims specifically.

Source: Three Ways AI Can Tackle the Claims Adjuster Staffing Gap – CLARA (claraanalytics.com)

AI technology has significantly impacted the roles of travel insurance adjusters in several ways, bringing about changes in processes, responsibilities, and overall efficiency. With the adoption of AI, many manual tasks in claims adjustment, such as data entry, document processing, and initial risk assessment, have been automated.

Automation of the travel insurance process has streamlined the claims handling process, reducing the time and effort required for routine tasks. AI technologies, such as machine learning algorithms, have improved the speed and accuracy of claims handling by quickly assessing large volumes of data to identify patterns and make predictions. It has led to faster and more accurate claim settlements, ultimately benefiting both insurers and policyholders.

As routine tasks become automated, adjusters are increasingly taking on the role of analysts and decision-makers. They now focus more on interpreting complex data, making strategic decisions, and providing valuable insights into the claims process.

According to travel insurance industry reports,

“AI adoption in claims adjustment has led to significant time and cost savings. About 60% of insurers believe that AI can cut the operational cost of travel insurance by up to 15%.”

Overall, the integration of AI has transformed the adjuster role, empowering them to be more analytical and strategic in their approach while also driving efficiency and cost-effectiveness in claims handling.

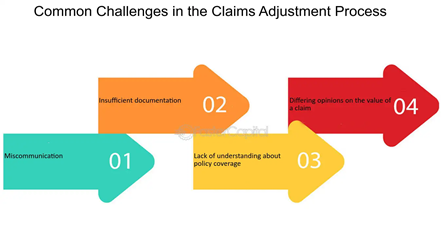

Source: Challenges in Claims – FasterCapital

The increasing use of AI in decision-making processes raises significant ethical concerns in travel insurance. AI algorithms may inadvertently perpetuate biases present in the training data, leading to discriminatory outcomes. Ensuring fairness, accountability, and transparency in AI decision-making is paramount to mitigate these ethical implications.

Integrating AI into existing travel insurance systems can be challenging due to technological barriers, legacy infrastructure, and interoperability issues. Organizations must carefully plan the integration process, considering factors such as data compatibility, system adaptability, and potential disruptions to existing workflows.

Transparency and accountability are crucial to building trust in AI systems. Travel insurance organizations must strive to understand and explain the rationale behind AI-driven decisions, provide avenues for recourse in the event of errors, and establish clear lines of responsibility for AI systems’ outcomes.

As AI becomes more prevalent, there is a growing need to train and upskill human adjusters to collaborate effectively with AI systems. It involves equipping them with the necessary technical knowledge, data literacy, and critical thinking skills to interpret and validate AI-generated insights, ultimately enhancing the overall decision-making process in travel insurance.

Source: LinkedIn

The travel insurance industry is poised to see significant developments and opportunities in the coming years, driven by technological advancements and changing consumer expectations. AI and machine learning technologies are expected to play an increasingly pivotal role in the travel insurance industry.

These advancements will enable insurers to streamline processes, automate underwriting and claims handling, and gain deeper insights into customer behavior and risk assessment. As these technologies become more sophisticated, insurers can expect to see improved operational efficiency, better risk management, and enhanced customer experiences.

With the integration of AI and big data analytics, travel insurers have the potential to offer personalized and proactive claims handling. By leveraging data from various sources, insurers can anticipate and mitigate risks, customize insurance products to individual needs, and provide real-time support to policyholders. This personalized and proactive approach has the potential to improve customer satisfaction, reduce claim processing times, and minimize fraudulent activities.

As the travel insurance industry embraces digital transformation, there will be significant growth opportunities for tech-savvy adjusters and innovative insurance companies. Professionals with expertise in data analysis, AI, and digital platforms will be in high demand to drive operational efficiencies and develop cutting-edge insurance solutions. Additionally, travel insurance companies that can adapt quickly to technological advancements and consumer preferences will have a competitive edge in the market.

The future of the travel insurance industry is ripe with opportunities driven by technological advancements, data analytics, and a shift toward personalized customer experiences. Embracing these trends will be crucial for insurers and professionals looking to thrive in this evolving landscape.

AI’s transformative impact on claims adjustment has massively revolutionized the travel insurance industry in several ways. AI has streamlined claims processing, reducing manual errors and improving efficiency. Advanced algorithms have enabled faster and more accurate claim assessments, leading to quicker settlements.

Data analytics powered by AI have facilitated better risk assessment, fraud detection, and personalized customer experiences. Embracing AI-driven changes is crucial for staying competitive and delivering enhanced services to customers. The integration of AI holds the promise of a more efficient, accurate, and customer-centric claims process, benefitting both insurers and policyholders.