Artificial intelligence (AI) has become increasingly prominent in transforming various industries in today’s rapidly evolving digital landscape. From healthcare to finance, AI has proven to be a game-changer, revolutionizing how businesses operate and deliver services. AI is poised to bring about significant advancements in insurance, reshaping traditional processes and enabling companies to operate with unprecedented efficiency and precision.

This article explores the potential benefits of integrating AI modules with existing insurance systems. We aim to show how this integration can enhance operational efficiency, reduce costs, and ultimately elevate customer satisfaction within the insurance sector.

Throughout this article, we will delve into the following key areas:

Source: The current state of the insurance market (propertycasualty360.com)

Traditional insurance systems are often characterized by legacy systems with limitations from outdated infrastructure and technology. These legacy systems are marked by their rigidity, lack of scalability, and inability to adapt to modern demands. Despite these limitations, traditional insurance systems have been prevalent across the industry, with many insurance companies still relying on them for their operations. However, adopting these systems has declined recently as companies seek more agile and efficient solutions.

Key Statistics on the Adoption and Performance of Traditional Insurance Systems:

Traditional insurance systems face a myriad of challenges in today’s dynamic market, including:

Legacy systems often create data silos, hindering seamless data flow and integration across different departments within an insurance company. This leads to inefficiencies in data management and decision-making processes.

The maintenance and upkeep of legacy systems result in high operational costs for insurance companies, impacting their overall profitability and competitiveness in the market.

Outdated systems contribute to slow and cumbersome claim processing, which leads to customer dissatisfaction and increased administrative burdens for insurance providers.

Traditional systems lack the flexibility and capabilities to enable meaningful customer interactions and personalized services, which are increasingly crucial in today’s customer-centric insurance landscape.

Source: Artificial Intelligence-Modules Part I | by Shafi | DataDrivenInvestor

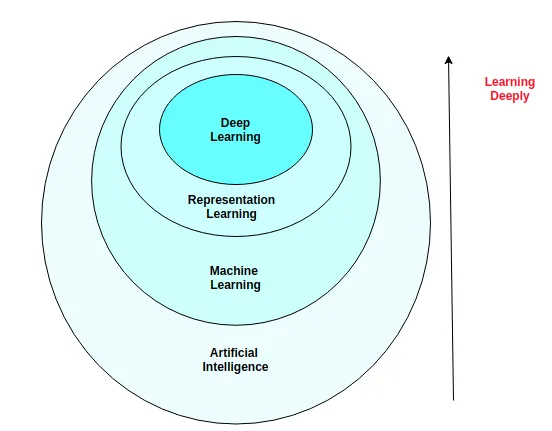

AI modules refer to the various components or units of artificial intelligence systems designed to perform specific tasks or functions. These modules can encompass various technologies and algorithms that simulate human intelligence to solve complex problems, automate processes, and make data-driven decisions.

AI has been increasingly utilized in the insurance industry to streamline processes, enhance customer experiences, and mitigate risks. Various types of AI are employed to achieve these objectives.

Chatbots and virtual assistants handle customer queries, process claims, and provide personalized policy recommendations, thereby improving customer service and reducing response times.

AI algorithms analyze vast amounts of data to assess risks more accurately, predict customer behavior, and detect fraudulent activities. This helps insurance companies in underwriting and pricing policies more effectively.

NLP algorithms extract and analyze information from unstructured data such as claim forms, policy documents, and customer communications, leading to faster and more accurate claims processing.

AI-driven telematics systems collect and analyze data from in-car sensors and GPS to assess driving behaviors, enabling the implementation of usage-based insurance models that offer personalized premiums based on individual driving habits.

AI-powered image recognition technology is used to assess property damages by analyzing images, thereby expediting the claims settlement process and reducing the need for physical inspections.

AI-based underwriting systems automate the evaluation of policy applications, enabling quicker and more accurate decision-making while ensuring adherence to regulatory requirements.

These AI applications are revolutionizing the insurance industry, leading to operational efficiencies, improved risk management, and enhanced customer satisfaction.

AI plays a pivotal role in revolutionizing the insurance sector by providing several key benefits, including:

Several case studies demonstrate the impactful applications of AI in the insurance industry:

Source: Strategies For AI Integration In Business Frameworks (inc42.com)

AI bridging the gap by integration of the following strategies:

When integrating new AI systems, it’s crucial to begin by evaluating the compatibility of existing systems. This involves conducting thorough compatibility checks and identifying potential areas for upgrades within the current infrastructure. By understanding the strengths and limitations of the existing systems, organizations can better plan for a seamless integration process. Identifying integration points is also essential to ensure the new AI modules can effectively communicate and synchronize with the current technology landscape.

A phased implementation approach is often the most effective strategy when integrating AI into existing systems. This involves conducting pilot programs to test AI modules on a small scale, allowing for the identification of any initial issues and the refinement of the integration process. Gradual scaling is then employed, where successful AI modules are progressively expanded across different areas of the organization before achieving full integration. This approach minimizes disruptions and allows for gradually adapting technology and personnel to the new systems.

In the insurance industry, ensuring data security and compliance is paramount when integrating AI systems. Organizations must prioritize data privacy and implement robust, secure data handling and storage strategies. This involves adhering to regulations such as GDPR and HIPAA, which set stringent data protection and privacy standards. Compliance with these regulations not only safeguards sensitive information but also helps build trust with customers.

Incorporating AI into insurance processes enables the automation of routine tasks such as claim processing and underwriting. By leveraging AI algorithms, mundane and repetitive tasks are streamlined, leading to significant time and cost savings.

For example, claims processing can be expedited through AI-powered data extraction and analysis, resulting in faster settlements and reduced operational expenses. Similarly, underwriting processes can be accelerated through automated risk assessment, enhancing overall operational efficiency and reducing the likelihood of human error.

AI integration allows for predictive analytics in risk assessment, leading to improved accuracy and reliability. By analyzing vast amounts of data, AI systems can identify complex patterns and trends that human analysts may overlook. This capability enhances risk assessment models, leading to more precise underwriting decisions and reduced exposure to potential losses.

Case studies have demonstrated how AI-driven risk assessment has reduced insurers’ risk exposure and more accurately priced premiums, ultimately contributing to improved profitability and sustainability.

Reduced health insurance renewal from 15 to 19 percent by showing action toward the goal of a healthier population through wellness programs, tobacco cessation programs, primary care visits for premium discounts, and other health-related activities.

AI integration in the insurance sector facilitates personalized customer experiences through various means, such as chatbots and customized policy recommendations. AI-powered chatbots can efficiently handle customer queries, providing quick and accurate responses, thereby enhancing customer satisfaction. Moreover, AI algorithms can analyze customer data to offer personalized policy recommendations tailored to individual needs, ultimately improving customer retention rates and overall satisfaction.

Source: 6 AI Implementation Challenges And How To Overcome Them (elearningindustry.com)

When integrating AI into existing systems, organizations often face technical barriers such as data integration and system interoperability. To overcome these challenges, best practices include conducting a thorough assessment of existing systems, utilizing standardized data formats, and implementing middleware solutions for seamless interoperability. Employing robust data governance practices and utilizing application programming interfaces (APIs) can facilitate smoother data integration.

Effective change management is crucial when integrating AI. Providing comprehensive training to employees on the new AI systems and ensuring stakeholder buy-in is essential for successful implementation. Organizations should also focus on creating a culture that embraces technological change, encouraging open communication, and addressing concerns to foster a positive attitude toward AI integration. Embracing agile methodologies and involving employees in decision-making can also facilitate smoother transitions.

Organizations often grapple with the initial investment required for AI integration, but it’s essential to consider the long-term savings and return on investment (ROI). Case studies showcasing successful AI integrations and their tangible ROI can provide insights into the long-term benefits. Organizations can make informed decisions regarding AI integration by evaluating the potential efficiency gains, cost reductions, and revenue enhancements, understanding that the initial investment can lead to substantial long-term savings.

Source: AI Trends of the Future – HubEngage

The insurance industry is witnessing the emergence of cutting-edge AI technologies that are revolutionizing insurance processes. One such development is the integration of AI with the Internet of Things (IoT), allowing insurers to gather real-time data from connected devices to assess risks and personalize insurance offerings. Additionally, integrating blockchain technology with AI streamlines claims management and underwriting processes, enhancing transparency and security within the insurance ecosystem.

The potential future applications of these AI technologies in insurance are vast. AI-powered IoT devices can enable proactive risk assessment, preventing losses and reducing claims. Furthermore, the utilization of AI and blockchain can lead to more efficient and accurate fraud detection, enhancing the overall integrity of the insurance sector. These innovations are poised to bring significant benefits, including streamlined operations, improved customer experiences, and more personalized insurance products tailored to individual needs.

AI is set to fundamentally shape the insurance industry’s future landscape. Experts predict that AI will be pivotal in automating routine tasks, enabling insurers to focus on higher-value activities such as complex risk assessment and personalized customer service. Market analysis indicates that AI-driven predictive analytics will lead to more accurate risk evaluation, proactive claims management, and the development of innovative insurance products tailored to emerging consumer needs.

Furthermore, AI’s influence is expected to extend beyond operational enhancements, transforming how insurance is underwritten, priced, and distributed. As AI technologies evolve, they are anticipated to drive greater operational efficiencies, cost savings, and improved risk management within the insurance sector. In essence, the future of insurance is intricately tied to the advancements and widespread adoption of AI, heralding a new era of innovation and competitiveness within the industry.