Inefficient claims processing can be a major headache for travel insurers due to lengthy communication, incomplete information, and frustrated customers. This is why many insurance providers have been leaning towards automations and other innovative strategies to transform their existing systems.

Among these strategies is the adoption of claims submission portals that enable policyholders to easily submit their claims with just a few clicks. Lea’s Hyper-Customized Online Claim Submission Portal stands out in this field, offering a solution that simplifies the entire claims submission process.

In this article, we will explore one of Lea’s core modules—the Hyper-Customized Online Submission Portal, its key features and the benefits it provides to travel insurers in overcoming common claims management challenges.

Let’s dive in!

Traditional claims processing methods often create a frustrating experience for both travel insurers and policyholders. Here’s a closer look at the most common pain points and their impact on both parties involved:

Reliance on phone calls and email exchanges to gather information creates significant delays and inefficiencies. This translates to increased operational costs for insurers with call centers and adjusters spending a considerable amount of time collecting basic information. Policyholders experience frustration due to long wait times and repeated requests for the same information, leading to a negative perception of the claims process.

Manual data entry and paper-based documentation often lead to missing or inaccurate information, which in turn, necessitates further communication with policyholders. This can cause delays for insurers and potentially impact financial reserves due to uncertainties in claim validity.

Traditional claims processing relies heavily on call centers, creating a domino effect of problems. High call volume overwhelms staff, leading to long wait times and a strained customer experience. This frustration can manifest in negative interactions with customer service representatives, potentially impacting the quality of service and increasing the likelihood of errors. Ultimately, both insurers and policyholders feel the sting of this inefficient system. Insurers face rising operational costs due to high call volume, while policyholders grapple with long waits and a negative perception of the insurance company.

Travel insurance should be there to provide peace of mind, but a slow and complex claims process can have the opposite effect. The lack of transparency and a confusing maze of steps can leave policyholders feeling frustrated and unsupported. Unrealistic timelines and a sense of being “in the dark” create a feeling of helplessness and dissatisfaction with the travel insurance provider. This ultimately leads to a negative claims experience that damages trust and loyalty.

Disgruntled customers who feel unsupported during their time of need are less likely to renew their policies. Insurers can turn this negative perception around by simplifying the process and providing clear communication.

A disorganized claims process can create confusion for everyone. Without a clear system, it’s difficult for both insurers and policyholders to know what to expect. Unrealistic timelines from policyholders can lead to frustrations and arguments, making it harder for insurers to provide good customer service. Also, if ineligible claims slip through the cracks, it can hurt the insurer’s finances.

For policyholders, unclear timelines can be stressful, and unexpected claim denials can cause financial hardship. By streamlining the process and identifying ineligible claims early, everyone comes out ahead.

Lea’s Hyper-Customized Online Claim Submission Portal is designed to address the inefficiencies and frustrations commonly associated with traditional claims processes. This module simplifies the entire claims submission journey, ensuring complete and accurate information is collected from the start.

Lea’s Online Claim Submission module is packed with features designed to make submitting claims a breeze:

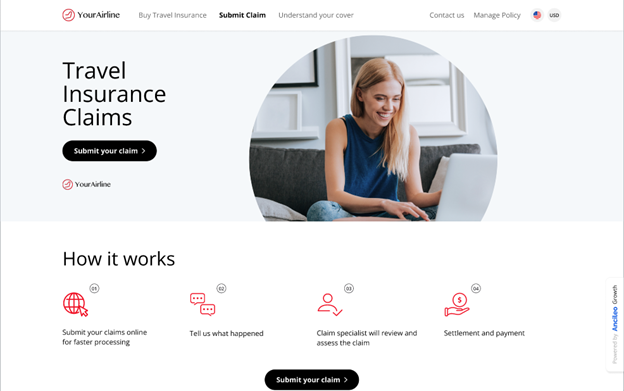

Lea’s Online Claim Submission module offers a user-friendly experience for policyholders while simultaneously streamlining the claims process for insurers. Here’s a walkthrough of the process:

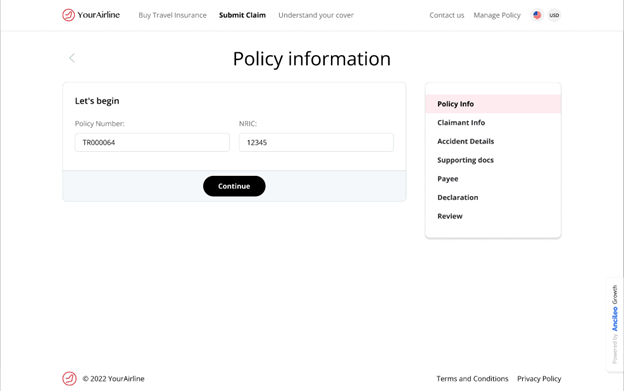

Step 1: Enter Policy Information

The process begins with the claimant entering their policy number and ID. This retrieves and verifies their policy details, ensuring that the correct information is used throughout the submission process.

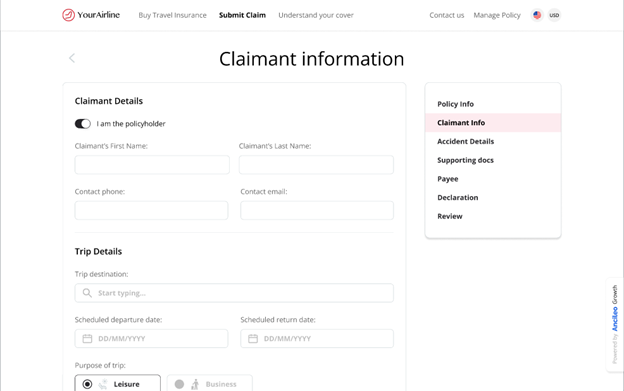

Step 2: Provide Claimant Information

The claimant then provides their personal and trip details, including contact information, travel dates, and destinations.

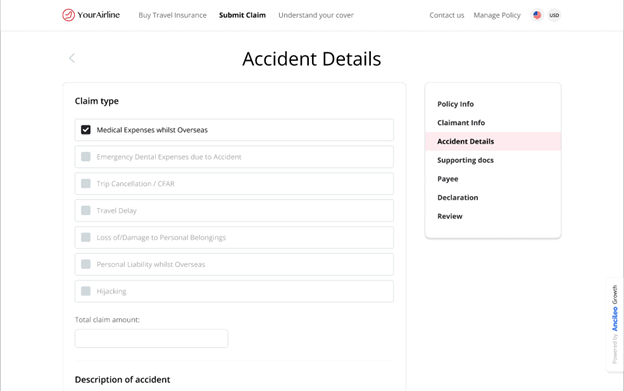

Step 3: Describe the Accident Details

The claimant specifies the type of claim and describes the incident in detail. The portal guides them through necessary prompts to ensure that all required information is collected.

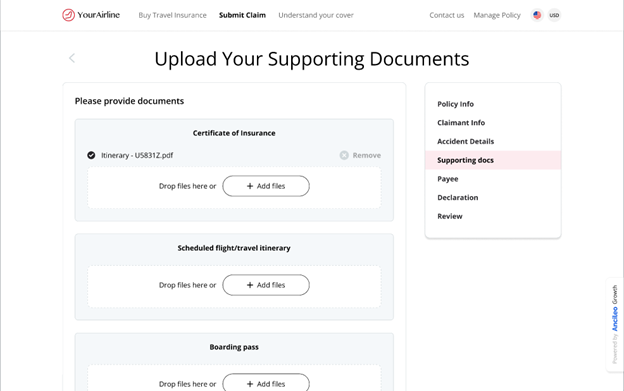

Step 4: Upload Supporting Documents

The claimant uploads essential documents, such as the certificate of insurance, flight itinerary, and boarding pass. The portal supports multiple file formats and provides clear instructions for a smooth upload process.

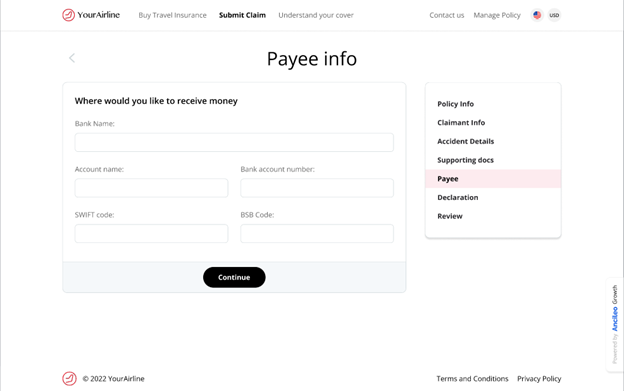

Step 5: Submit Payee Information

Next, the claimant provides bank details for reimbursement, including account number and other necessary banking information.

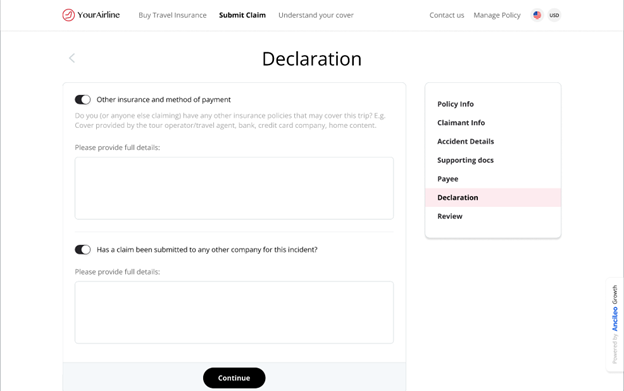

Step 6: Make a Declaration

In this step, the claimant declares any other insurance claims related to the incident. This helps insurers identify potential overlaps with other policies and streamline the assessment process.

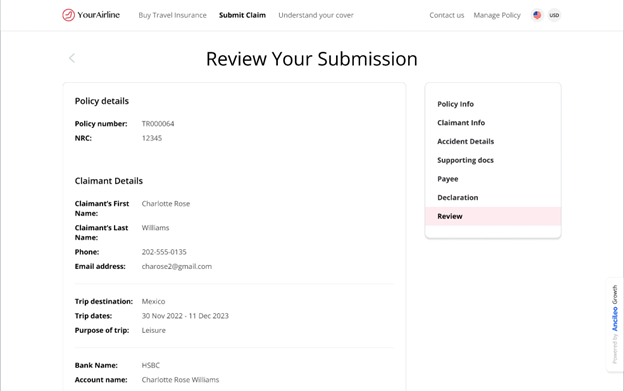

Step 7: Review and Submit the Claim

Finally, the claimant reviews all provided information. They can easily navigate back to any section to make changes if needed. Once satisfied, they submit the claim. An automated confirmation receipt is generated.

Lea’s Hyper-Customized Online Claim Submission Portal turns a traditionally cumbersome process into a streamlined and efficient workflow. This transformation not only enhances the customer experience but also enables travel insurers to manage claims more effectively, reducing costs and improving overall satisfaction.

The online claim submission module of Lea isn’t just a portal; it’s a powerful solution that streamlines the claim process, delivering a host of benefits for both travel insurers and policyholders:

For Insurers: Boosting Efficiency and Reducing Costs

For Policyholders: A Faster, Easier Claims Experience

Lea’s approach to claims processing extends far beyond its Hyper-Customized Online Claim Submission Portal. It offers a comprehensive suite of seven AI-powered modules, each designed to improve different aspects of the claims process, ensuring both insurers and policyholders have a smoother, more effective experience:

Lea’s intuitive online portal guides claimants through every step of the claims submission process, making it easy to provide all necessary information upfront. Reducing the need for back-and-forth communication saves time for both the claimant and the claims handlers.

All claim details, documents, and communications are organized in a single, easily accessible workspace. This setup promotes collaboration among team members, allowing anyone involved to quickly understand the status and specifics of a claim, thereby enhancing efficiency.

LEA uses advanced AI to handle rule-based management, document verification, and fraud checks. This enables real-time claim assessment and decision-making, allowing claims examiners to focus on more complex cases that require personalized attention.

This module allows policyholders to manage their policies independently, reducing the need for call center interventions and enhancing user convenience.

LEA ensures exceptional customer care through a variety of communication channels. This module integrates all customer interactions into a unified platform, providing consistent and responsive support across multiple channels, ensuring that customers are always connected and supported.

Proactively reach out to policyholders with personalized communications throughout the claims process, keeping them informed and engaged.

The Advanced Claim Analytics module offers deep insights into claims data, helping insurers identify patterns and optimize their claims processes for better efficiency and decision-making.

Lea’s Hyper-Customized Online Claim Submission Portal transforms the claims process for travel insurers and policyholders. By addressing traditional pain points, this module simplifies claims submission, reduces inefficiencies, and enhances customer satisfaction. Its intuitive interface, guided steps, seamless document uploads, secure payee information, and real-time tracking ensure a smooth, transparent experience.

For insurers, this means lower operational costs, better data accuracy, and improved risk management. Policyholders benefit from faster payouts, less frustration, and greater control over their claims. Lea’s suite of AI-powered modules, including Automated Claims Assessment, Centralized Collaborations Claims Hub, Customer Self-Serve Policy Management, Omni-Channel Customer Service, and Advanced Claim Analytics, further optimize the claims process.

Adopting Lea’s technology enables insurers to enhance efficiency and build stronger relationships with policyholders, setting a new industry standard for streamlined, effective claims management.