Generative AI (Artificial Intelligence) has certainly been making a buzz in many industries, including the travel insurance sector. As its name suggests, generative AI is a category of AI capable of creating original content such as text, audio, images, and videos.

Generative AI looks really promising in travel insurance, as many of the businesses within this sector have been making strides utilizing it. However, the question remains: Can generative AI truly revolutionize the travel insurance landscape, or are there challenges and limitations that warrant careful consideration? Let’s find out all of these in this article.

As mentioned, generative AI is capable of generating new, digital contents. In contrast to being explicitly programmed, it learns patterns from data and uses that knowledge to generate content that wasn’t specifically pre-programmed. Generative AIs use advanced systems and algorithms to operate autonomously, creating content without explicit human input.

A prime example of Generative AI is OpenAI’s ChatGPT. This technology stands out for its proficiency to produce coherent and contextually relevant responses in real-time. Generative AIs like ChatGPT continue to transform interactions and are paving the way for innovative applications in the entire landscape of travel insurance.

Generative AI’s ability to learn patterns and adapt dynamically to changing data sets it apart from traditional technologies. Traditional technologies often rely on predefined rules, limiting their flexibility in handling the complexity of travel insurance scenarios. Generative AI, on the other hand, excels in understanding context, inferring meaning, and generating contextually relevant content. These capabilities position Generative AI as a potent tool for travel insurance companies, offering the potential for more accurate risk assessments, personalized policy offerings, and real-time customer support.

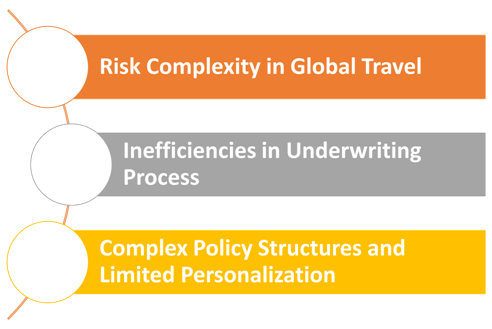

To better understand how generative AI can transform travel insurance, it’s essential to first examine the current challenges faced by the industry.

The presence of geopolitical instability, natural disasters, and health crises requires continuous adaptation to ensure policies remain relevant and provide adequate coverage. This challenge necessitates a dynamic approach to risk assessment, where insurers must stay informed about the unique risks associated with each destination. The unpredictability of global events requires travel insurers to adopt agile strategies, ensuring that insurance policies evolve alongside the ever-changing nature of risks.

Traditional underwriting processes often rely on manual assessments, leading to delays in policy issuance. The lack of real-time data integration and analytics further hampers insurers’ ability to respond swiftly to emerging trends and risks.

This challenge emphasizes the need for a more streamlined and technologically advanced approach to underwriting. Automated risk assessments and real-time data analytics can significantly improve the efficiency of the underwriting process, allowing travel insurers to issue policies promptly and adapt to changing circumstances.

The complexity of policy structures and the lack of personalization in travel insurance offerings present a barrier to providing a seamless and tailored experience for travelers. Navigating through intricate policies can be challenging for customers, impacting their overall satisfaction.

To address this challenge, travel insurers need to simplify policy structures and incorporate personalization into their offerings. Tailoring insurance policies based on individual travel patterns and preferences can enhance the overall customer experience, fostering stronger connections between insurers and policyholders.

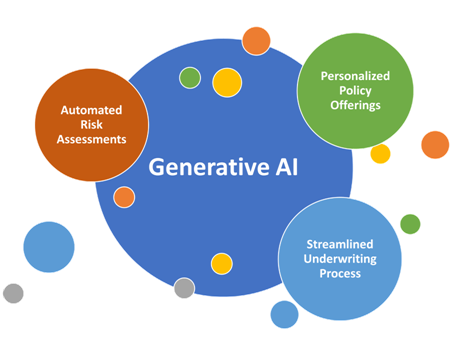

Generative AI emerges as a powerful solution to address the challenges faced by the travel insurance sector. With the right implementation, this AI technology can offer the following benefits to insurers:

Generative AI may step into the role of an analyst. When properly utilized, generative AI can help streamline risk assessments by automating the analysis of complex and dynamic data associated with global travel risks. This ensures a more accurate and real-time evaluation of potential hazards, allowing travel insurers to adapt their policies swiftly in response to emerging threats.

With the help of generative AI, travel insurers can reduce inefficiencies and expedite policy issuance. The technology’s ability to process and analyze complex data greatly enhances the overall efficiency of underwriting. We can think of it as a personal assistant for insurers that can effortlessly process extensive datasets at remarkable speeds. This isn’t just about keeping up with the dynamic landscape of insurance, but also setting a new benchmark for operational efficiency.

Generative AI transcends mere data analysis. It can also be used to personalize policy offerings based on individual travel patterns and preferences. Travel insures can tailor coverage to meet the specific needs of each traveler, providing a more relevant and satisfying insurance experience.

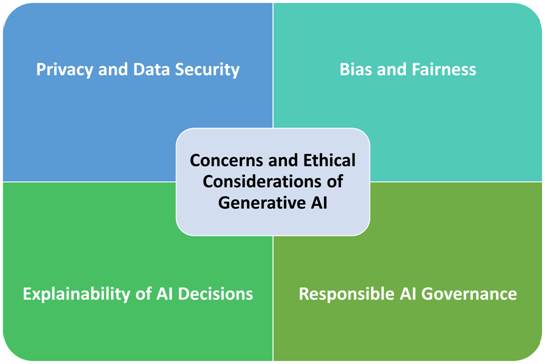

The integration of generative AI in travel insurance brings forth numerous benefits, but it is not without its share of concerns and ethical considerations. As with other technologies, it’s crucial for travel insurers to also navigate these considerations to ensure that the implementation of generative AI aligns well with industry standards and ethical principles.

Privacy and data security will always be areas of concern when we talk about technology integration, and such is also the case for generative AI. The extensive use of data for risk assessment and personalization raises questions about how customer data is handled, stored, and protected.

To address this, travel insurers must be committed to robust data encryption, anonymization practices, and compliance with data protection regulations. Stringent security measures must also be in place so that customer information is handled responsibly, fostering trust between travel insurers and policyholders.

The inherent biases present in data used to train generative AI systems can unfortunately result in biased outcomes. This can potentially impact policy pricing, coverage decisions, and overall fairness. Travel insurers must be proactive in identifying and mitigating biases in training data. They must invest in resources that will perform regular audits to ensure unbiased decision-making. This commitment to fairness helps build a reputation for equitable and trustworthy practices.

Since generative AI is working autonomously, its decisions are less transparent and understandable to the end-user. Lack of transparency may lead to customer distrust. That’s why it’s important for travel insurers to also invest in technologies and resources that provide clear and understandable explanations for AI-generated decisions.

The lack of well-defined guidelines about the ethical application of AI in the travel insurance sector gives rise to concerns regarding governance and accountability. It is crucial to establish comprehensive AI governance frameworks that encompass policies, regular audits, and mechanisms for ongoing improvement. Through the adoption of responsible AI governance, travel insurers can showcase their dedication to ethical standards and accountability within the industry.

While generative AI holds great promise for revolutionizing the travel insurance sector, it is essential to address concerns and uphold ethical considerations. Proactively tackling issues like privacy, bias, transparency, and governance can help travel insurers guarantee the responsible integration of generative AI.

The potential offered by generative AI is accompanied by the need for deliberate and considerate navigation. As the travel insurance sector undergoes this technological evolution, it becomes imperative to prioritize addressing issues related to privacy, biases, explainability, and ethical governance. Effectively integrating generative AI responsibly requires the implementation of robust data security measures, proactive strategies to mitigate biases, transparent decision-making processes, and a steadfast commitment to ethical AI governance.

In essence, the impact of generative AI in travel insurance is not solely rooted in its transformative capabilities but is intricately tied to the meticulous and conscientious approach adopted by insurers. By actively confronting concerns and upholding ethical standards, travel insurers can not only unlock the potential of generative AI but also set the stage for a future where innovation seamlessly aligns with responsibility, fostering trust and satisfaction among customers.