In our research, Germany stood out among other markets to have the highest percentage of respondents that prefer to purchase directly from insurers. This statistic reflects the high consumer trust that German consumers have of insurers.

Of course, the potential is not limited to only that. The appeal of the high trust enjoyed by insurers can be further leveraged upon by optimizing digital capabilities and services beyond the B2C website, accepting more modes of payments like crypto, investing in genuine social branding, among others in the digital marketers’ playbook in 2022.

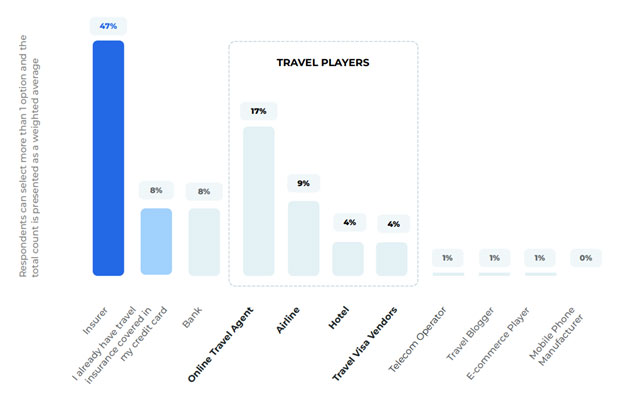

The prospects for travel players in the insurance distribution marketplace and embedded insurance partnerships remain limited when compared to other markets, but are up and coming. With more than half of the respondents (53%) being open to purchase travel insurance from non-insurers but only about ¼ of them (26%) likely to purchase in-path/embedded insurance, what else does it take to close the gap?

Insurers direct channel still preferred among German consumers, but open to purchase from travel players

In this article, we delve into the German market to find out what ticks for consumers when it comes to travel insurance in 2022. The consumer research is part of Ancileo’s 2022 Travel Insurance Whitepaper, in which you can find the key highlights gathered from the global research deck in our post here.

84% amongst consumers who are not planning to travel indicated that they would purchase travel insurance if they were to travel for essential reasons. Most of whom intend to travel internationally are Gen X and Y consumers.

There is almost an equal split of travelers with insurer brand loyalty and travelers without preferred travel insurance brands. You can find the top insurance brands patronized by the surveyed consumers in the below infographic.

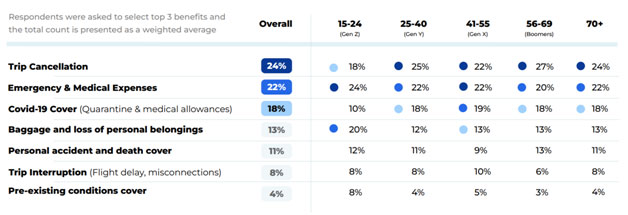

For those without a preferred travel insurance brand, we can tell that the impact of the pandemic has been key to influencing their decision to get insurance to protect against the risks and uncertainty of traveling. Trip cancellation and medical coverage have been proven to be top reasons to buy travel insurance.

Top reasons to buy travel insurance

As we talk about top influencing factors when evaluating a plan to purchase, price remains as a clear contender across almost all of the markets. Breaking down by consumer groups:

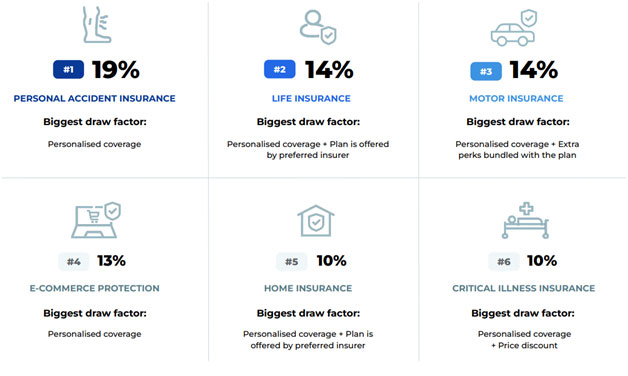

In the infographic below, you can find the top services most valued by travelers and can be capitalized on to incentivise potential consumers to purchase travel insurance from you:

Additional travel insurance services most valued by German travelers

More than half of the respondents surveyed (57%) indicated that they are “unlikely to purchase” in-path/embedded insurance. The reasons range from:

On the other spectrum for those who may consider purchasing in-path, we gathered some insights that insurance distributors could optimize to boost conversion rates via in-path/embedded means:

Moving on to their receptiveness to purchase from travel players, we break down the motivating factors to purchase from travel players by consumer groups:

Some other product opportunities that can be tapped upon by travel players in the insurance distribution marketplace are reflected in the below infographic:

As a final note, we want to highlight the potential of partnerships in Germany. Currently, the landscape for partnerships between insurers and insurtechs is incredibly vibrant, with Munich re leading in this regard (Read more: Germany’s insurtech market matures and consolidates – Pinsent Masons). This sets the precedent and lowers the barriers to entry for insurers to collaborate with different industries to distribute insurance in a seamless manner via digital means.